Polymarket is Polygon’s lifesaver. Not only does it generate traffic, but validators also receive decent fees—not too much, but just enough. The prediction market was pivotal in giving a near-precise picture of what voters thought of the November 2024 presidential election. When the mainstream media vouched for Joe Biden, odds were stacking against the incumbent with many on Polymarket placing bets backing Donald Trump.

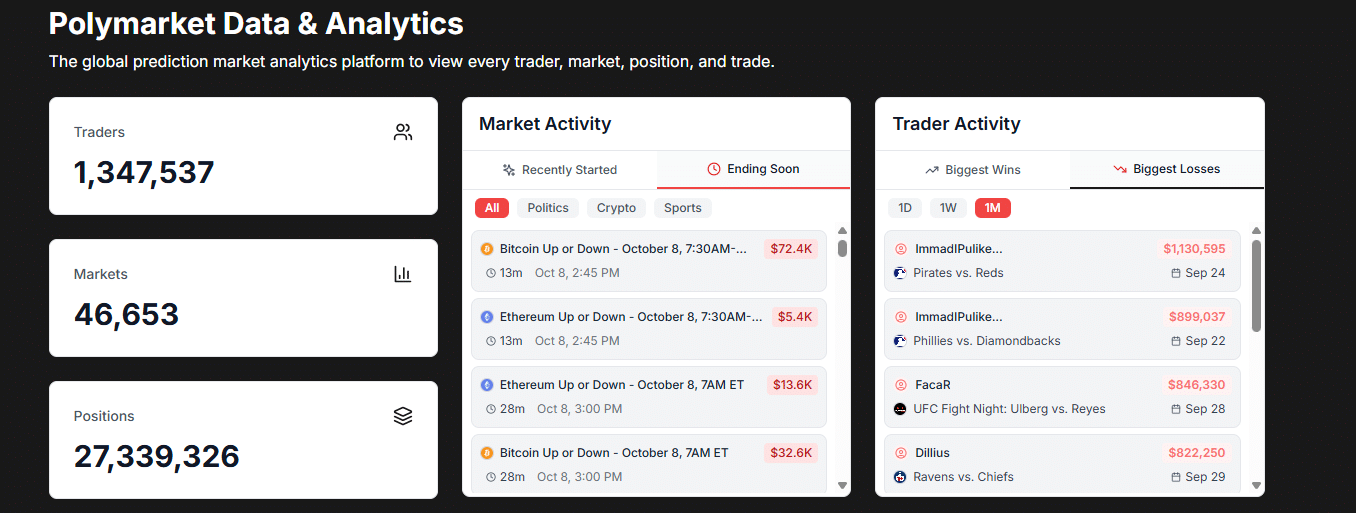

As of October 8, there were over 1.3M traders actively placing bets on the over 46,600 different markets or events. In general, over 27.3M positions had been closed. Out of the many events closed over the last month, the largest trader won more than $1.2M while another ended up losing $1.1M.

(Source: Polymarket Analytics)

If anything, Polymarket’s growth has been explosive in 2025. Trading volume, data shows, is up 10X year-on-year, and the more bets placed, the more revenue the platform generates. By 2035, the prediction market is projected to hit $153Bn, and if Polymarket retains this dominance, it only means one thing: Developers must innovate to enhance user experience.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Problem With Polymarket Trading

Part of this innovation means changing how punters trade events. At the moment, you can only buy “yes” or “no” predictions. There is no in-between.

To illustrate, the “New York City Mayoral Election” is trending as of October 8. Over $133M in trading volume has been generated in this event alone, which will resolve and pay out punters on November 4 after voting.

(Source: Polymarket)

As popular as this event is, there are two options. You can bet on Zohran Mamdani to win by buying “yes” shares for $0.877 each, or bet against him by buying “no” shares for $0.125 each. If Mamdani wins and you buy $100 worth of shares, your return will be $114.03.

The problem is that, at current share price rates, it is hard to track prices over time as Mamdani’s popularity changes. By mid-June, Andrew Cumo had a better shot, with over +79% of punters backing him.

This changed rapidly, and by late June and throughout July, Mamdani’s popularity soared. Only +10% of all traders think Cumo can win on the November 4 vote.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Trade Polymarket Events List Stocks And Best Cryptos To Buy?

A developer wants to change all this by making trading Polymarket events as simple as trading stocks or some of the best cryptos to buy like Solana.

Following the $2Bn investment by ICE on October 7, the idea will be to distribute Polymarket’s data to “thousands of financial institutions worldwide.”

One developer is now building an open-source repo dubbed Poly Data to collect, store, process, and update the world’s most interesting dataset. The repo features a solution that stores markets and order-filled events in a single sheet, effectively converting opaque event data into easy-to-trade data that “any researcher can understand.”

(Source: defiance_cr, X)

This repository allows for the analysis of Polymarket data and the prediction of top events based on supply and demand, similar to stock and crypto trading. While there will be no order book at the beginning, the developer plans to “store orderbook data” for historic book archives.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Trade Polymarket Events Like Stocks, Crypto

- Polymarket dominates the prediction market

- Trading events presently hard

- Developer wants to simplifying event analysis and trading

The post Breakthrough: Trade Polymarket Events Like Stocks Or Crypto appeared first on 99Bitcoins.