Mantle price has surged over 125% in the past 30 days, becoming one of the best performers during the period. However, can the current bullish momentum hold against the growing trend of smart money exits?

Summary

- Mantle price has hit a new all-time high of $2.86 on Thursday.

- The token’s ongoing rally could potentially face some pullback if smart money continues to exit.

- Retail demand from Mantle’s recent partnerships appears to be absorbing the additional selling pressure from smart money, at least for now.

According to data from crypto.news Mantle (MNT) set a new all-time high of $2.86 on Oct. 9, Asian time, before stabilizing at $2.71 at press time. At this price, the token remains 41.8% over the past 7 days and nearly 127% over a 30-day period.

The token’s daily trading volume rose from roughly $263 million on Sep. 9 to a peak of $717 million during today’s busiest trading hours, while its market cap soared from $3.8 billion to nearly $8.8 billion over the same period, showing strong interest from traders.

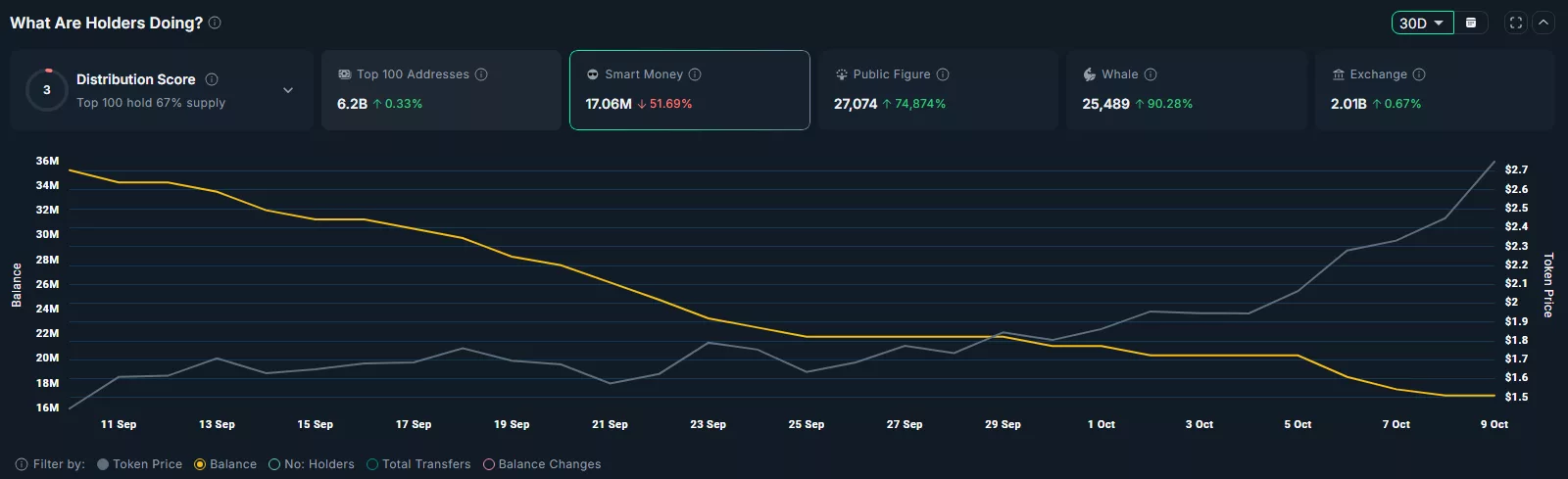

While the token is yet to show any signs of slowing down in terms of price action, some concerning on-chain data has come to light that could weigh on trader sentiment. Notably, smart money wallets, or traders with deep liquidity and early exposure, have been offloading their MNT holdings, likely locking in profits and rotating into competing tokens.

Data from Nansen reveals that the total amount of tokens held by smart money wallets dropped sharply from 35.31 million on Sep. 10 to just 17.06 million by Oct. 9.

Smart money exit is often viewed as a cautionary signal by retail traders, many of whom tend to follow these big players. As such, the FOMO from the recent rally could easily flip into panic if signs of distribution continue.

As of now, the demand from retail investors seems to be overshadowing the narrative and absorbing most of the tokens offloaded by smart money. Investors are showing no signs of fatigue or hesitation, and the token was up nearly 20% in the past 24 hours while its trading volume had surged over 56% during the same period.

Open interest in Mantle’s futures market also jumped 24% to hit an all-time high of $506.97 million, data from CoinGlass show. Notably, this figure was just $246 million at the beginning of October. At the same time, its weighted funding rate has also remained positive for the past eight days, while the long/short ratio was 1.07 as of press time.

A positive weighted funding rate indicates that long positions are dominating, with traders willing to pay a premium to keep their bullish bets open. A long/short ratio above 1 reinforces this sentiment, showing that more market participants expect prices to move higher.

Taken together, these metrics imply that bullish momentum around Mantle is still strong, with both retail and institutional traders positioning for further upside in the token when writing.

This positive momentum appears to be driven by three main catalysts, notably Mantle unveiling a new compliance-oriented RWA service at Token2049, its headline partnership with Trump family-backed World Liberty Financial to launch the USD1 stablecoin on its network, and its integration with crypto exchange Bybit, which has increased visibility and liquidity for MNT in recent weeks.

Mantle price action has confirmed a breakout from multiple bullish structures on the weekly chart, signaling a strong shift in momentum. Most notably, MNT has cleared the neckline of a multi-month double bottom formation at $1.42, a setup where the price forms two rounded troughs before pushing higher.

In technical terms, breaking above the neckline of such a pattern often opens the door for a sustained upside move, as it reflects a shift from accumulation to demand-driven rallying.

The token has also broken out of a rising parallel channel, which is defined by higher lows and higher highs moving within a steady upward band.

A breakout from both the double bottom and the channel in close succession typically signals the beginning of a strong bullish trend, especially when accompanied by high trading volume and positive project developments, both of which are currently in play for Mantle.

However, the token could face some correction before the rally begins, as the Relative Strength Index was sitting at 84, placing it in overbought territory. It should be noted that an overbought RSI is quite common during periods of a strong uptrend for a related token.

For now, the key resistance for MNT lies at $3 psychological resistance level. A clean break above that could pave the way for a push toward $4. On the flip side, it is important that MNT holds the $2.36 support level, which aligns with the 78.6% Fibonacci retracement. Holding that zone would help preserve the bullish momentum and keep the rally intact.