U.K-listed Bitcoin treasury firm the Smarter Web Company has declared a recent Bitcoin purchase worth $12.1 million, raising its holdings to 2,650 BTC.

Summary

- Smarter Web Company expanded its Bitcoin holdings by 100 BTC, investing £9.07 million ($12.1 million) as part of its long-term “the 10-year plan,” bringing its total reserves to 2,650 BTC valued at around $219.5 million.

- While corporate Bitcoin treasuries have grown significantly in 2025, with 346 entities now holding 3.91 million BTC, the strategy’s novelty and market enthusiasm appear to be waning.

On Oct. 13, the London-based company announced that it has increased its crypto holdings by 100 BTC. According to the company’s press release, the company invested as much as £9,076,366 ($12.1 million) into adding more Bitcoin to its portfolio, signaling the firm’s continued commitment to what it dubs “the 10-year plan.”

With the Smarter Web Company’s latest purchase, its total holdings have reached 2,650 BTC or equal to $219.5 million based on current market prices. This marks a significant step in the company’s long-held plan to establish a BTC treasury massive enough within the next few years. According to Bitcoin Treasuries, Smarter Web Company is ranked in 30th place among the top 100 public BTC treasury companies, beating HIVE Digital and Exodus Movement.

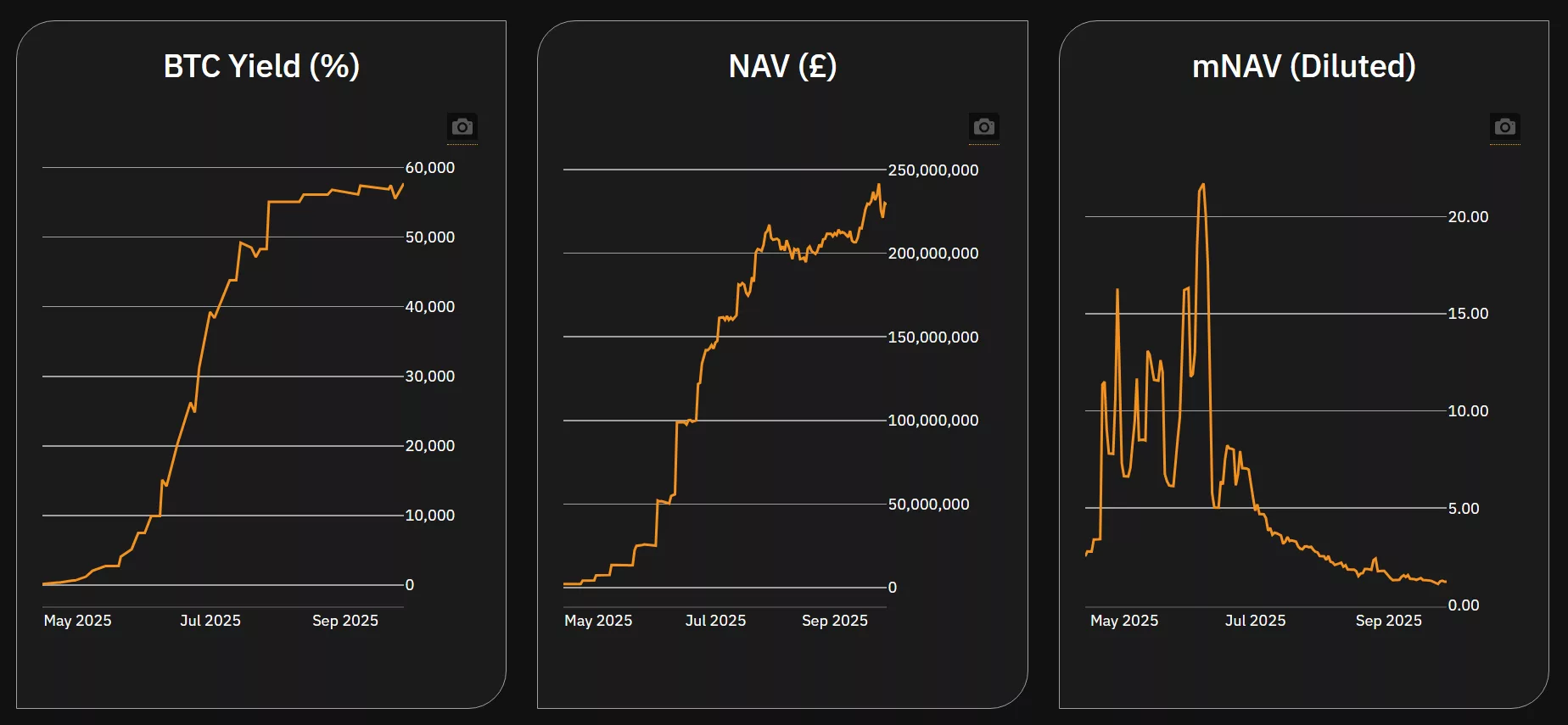

According to the press release, the company has generated BTC (BTC) yield of up to 57,718% on a year-to-date basis. Meanwhile, it has achieved a BTC Yield of 0.58% on a quarter-to-date basis on its current holdings.

Shortly after the BTC purchase was made, the Smarter Web Company’s stock saw modest gains of about 0.63% on the market. Although the increase is comparatively smaller compared to past stock jumps after it conducted Bitcoin purchases, it was able to pull the company’s share back from its downward trend.

In the past few days, the Smarter Web Company’s stock has been on the decline. In the past month, the stock has fallen nearly 30% from its previous peak at £1.59. Even though the company has been regularly purchasing Bitcoin throughout September and October, with its previous BTC purchase taking place on October 7, when it bought 25 BTC.

As of October 13, the company holds a total of 2,650 BTC in its reserves; meanwhile, its share price is trading below £1. According to the company’s official website, Smarter Web Company has a market Net Asset Value of 1.21. This means that investors are paying £1.21 in stock value for every £1 of treasury value held in BTC and cash.

Are Bitcoin treasuries still all the rage?

Over the past few months, the hype surrounding BTC treasuries has started to die down. At the start of June 2025, there were at least 60 companies out of the 124 total that began doubling down on their BTC treasury strategies, owning a combined 673,897 BTC or 3.2% of the supply.

Since then, the number has multiplied to 346 entities that hold BTC worldwide. On Oct. 13, there are 3.91 million BTC held in corporate treasuries. This means that stockpiling Bitcoin is no longer a novel business strategy, considering hundreds of companies have started adopting BTC into their operations.

This change in investor appetite for Bitcoin accumulation is reflected in Smarter Web Company’s share price. At its peak in June 2025, the share price bounded as high as £5, but now each share is valued at less than £1. Even with the constant BTC purchases, the company still has not managed to bump up its stock price to levels previously seen mid-year.