Is this the start of a bear market or its end? Bitcoin’s long, painful slide may be closer to the finish line than many fear. Analysts at Compass Point say the crypto bear market is entering its final phase, even after Bitcoin slipped below $81,000 and briefly dipped into the mid-$70,000s. Pushing BTC far below $60,000 would likely require a full-blown U.S. stock market selloff.

Compass Point points to $60,000–$68,000 as the floor for Bitcoin. Around 7% of long-term holders, people who have held BTC for six months or more, bought in this range.

Finding the floor is a psychological necessity: not only gives possible entries for buyers, but it also shapes decisions about panic selling versus patient holding.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

End Of Bear Market? Maybe Not Yet. Why Bitcoin Feels Shaky Between $70K and $80K

The area between $70,000 and $80,000 has shown limited structural support, with fewer than 1% of long-term holder supply originating there. Without a dense concentration of cost-basis buyers, price movements through this zone can accelerate downward, as fewer natural participants step in to absorb selling pressure. This explains the rapid drops observed recently when Bitcoin entered and moved through this level.

Support zones like these influence holder behaviour: stronger areas encourage continued holding, while thinner zones can contribute to quicker sales during periods of uncertainty.

EXPLORE: Top Solana Meme Coins to Buy in 2026

Spot Bitcoin ETFs and Institutional Dynamics

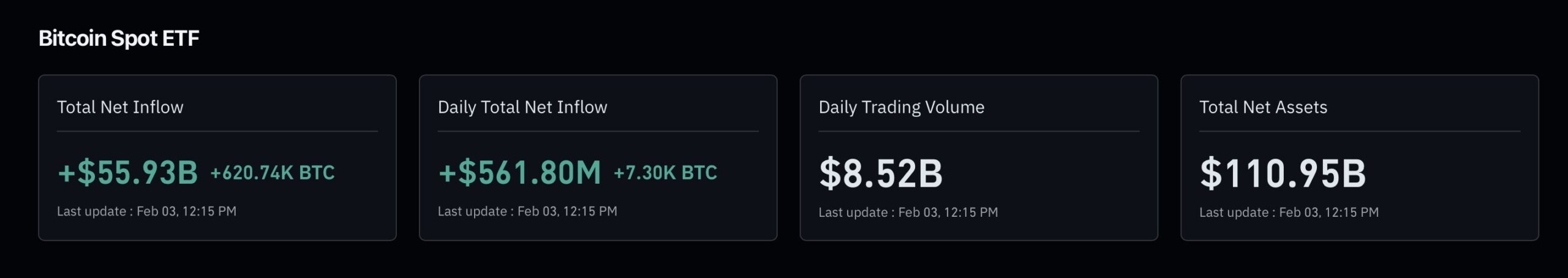

Spot Bitcoin ETFs continue to influence price action more directly since their introduction:

- Recent data shows periods of net outflows, though February 2 recorded inflows aof round $562 million (led by products like FBTC and IBIT), interrupting a prior streak.

- Year-to-date and multi-month figures reflect net outflows in the billions (e.g., around $1 billion YTD in some reports, with larger cumulative redemptions since late 2025), contributing to selling pressure as funds adjust holdings.

- Many ETF participants entered at higher averages (near $84,000 in some estimates), leaving a portion underwater and creating resistance near prior entry points like $81,000–$83,000.

(Source: Coinglass)

Bitcoin usually breaks its strongest floors only when stocks also enter a bear market. In 2022, it took both an equity crash and major crypto bankruptcies to push BTC below its average buyer cost, now near $55,000.

Institutional interest, including spot Bitcoin ETFs from major asset managers, still frames the long-term backdrop, even as regulators tighten oversight and central banks explore digital currencies.

The aggregated size of #Bitcoin treasuries held by public and private companies has grown from 197K BTC to 1.08M BTC, a ~448% increase since January 2023.

Corporate balance sheets are becoming an increasingly significant pillar of demand for $BTC. pic.twitter.com/8JFEbyHjRr

— ₿itlanger (@Bitlanger) February 3, 2026

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin Bear Market Nears End? Analysts Flag $60K as Line in Sand appeared first on 99Bitcoins.