Bitcoin reportedly pushed US spot ETF holders into $7 billion in paper losses after sliding below $80,000. Bitcoin USD briefly traded near $74,600 before bouncing toward $77,000, shaking investors who bought near the top. This drop occurred during a broader risk-off move, when stocks and crypto sold off together.

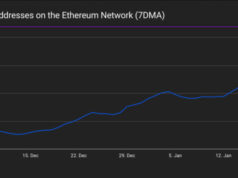

After a week of heavy outflows, BTC spot ETFs flipped back to net inflows.

• Feb 2: +7.3K BTC net inflow

• Buying led by IBIT, FBTC, ARKB, BITB

• GBTC remains flat, no major selling pressureAre we back?? pic.twitter.com/pgBc4byHx4

— Marzell (@MarzellCrypto) February 3, 2026

The pressure matters because ETFs now hold a large slice of Bitcoin supply. When these funds see red, their selling rules can turn a normal dip into a deeper slide.

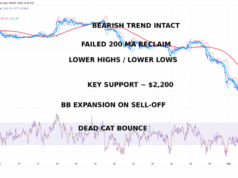

That’s why analysts warn Bitcoin could drift toward $65,000 if redemptions keep rising and fresh demand stays quiet.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

What Does a $7B ETF Loss Really Mean?

Right now, the average ETF buyer entered near $90,000. With Bitcoin USD well below that level, many holders sit on roughly 15% losses. Rallies then hit a wall as investors sell just to get back to even.

(Source: Bitcoin ETF / TradingView)

This feedback loop explains why Bitcoin ETF outflows worry the market more than spot selling by long-term holders.

Why ETFs Can Push Prices Down Faster

US spot ETFs now hold about 1.29 million Bitcoin. That’s roughly 6.5% of all coins that will ever exist. Add Strategy’s stash, and that figure jumps close to 10%.

When that much supply sits in vehicles built for risk control, volatility spikes. Over $800 million in leveraged trades vanished in minutes during the recent drop. Liquidity disappeared fast.

Unlike self-custody holders, ETF investors don’t always wait out storms. That’s why analysts flag downside risks for Bitcoin if stocks keep sliding.

DISCOVER: Top 20 Crypto to Buy in 2026

Why Strategy (MSTR) Looks Different

Strategy, formerly MicroStrategy, plays a different game. It holds Bitcoin on its balance sheet and uses debt and equity premiums to absorb swings.

This structure gives it a billion-dollar cushion that ETFs lack. When Bitcoin drops, MSTR doesn’t face forced redemptions. That flexibility explains why some investors treat the stock as a long-term proxy for Bitcoin.

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin. As of 2/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/x4BXtpl6UD

— Strategy (@Strategy) February 2, 2026

You can see how that approach works in Strategy’s Bitcoin holdings during past drawdowns.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Bitcoin ETF losses hit $7B as price risks $65K, MSTR cushioned appeared first on 99Bitcoins.