On December 17, Bitcoin saw a sharp and chaotic two-hour stretch that sent prices violently higher and lower within a short window.

The move began with a fast rally, then flipped just as quickly into a steep drop. Both sides of the market took hits. Each leg pushed Bitcoin roughly $3,000 in either direction, highlighting how aggressive trading had become during the session.

Bull Theory flagged the initial surge, noting that Bitcoin jumped about $3,300 in just 30 minutes. That spike forced the liquidation of roughly $106M in short positions.

BREAKING: Bitcoin pumped $3,300 and liquidated $106 million worth of shorts in just 30 minutes.

But then it dumped $3,400 and liquidated $52 million worth of longs in next 45 minutes.

Insane level of manipulation in crypto. pic.twitter.com/5zrlnsIhgj

— Bull Theory (@BullTheoryio) December 17, 2025

According to the analyst, the speed and scale of the move made it a textbook short squeeze.

But the strength did not last. Over the next 45 minutes, Bitcoin gave back nearly all of those gains. Prices dropped around $3,400, triggering about $52M in long liquidations.

Bull Theory described the reversal as a fast shift into a long squeeze, showing how quickly sentiment flipped.

Other market watchers pointed to the same episode from different angles. DEGEN NEWS described Bitcoin as printing “two straight volatile hourly candles,” emphasizing how unusual the back-to-back swings were.

ZeroHedge tied the move to its long-running “10 am slam algo” idea, calling it a near $5,000 swing within about an hour at the time of its post.

Both ZeroHedge and Bull Theory have pointed to a pattern they say shows up around 10:00 a.m. EST. That timing lines up with the opening of US stock markets. And it’s where some of these sharp Bitcoin moves tend to appear.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Bitcoin Price Action and Liquidations

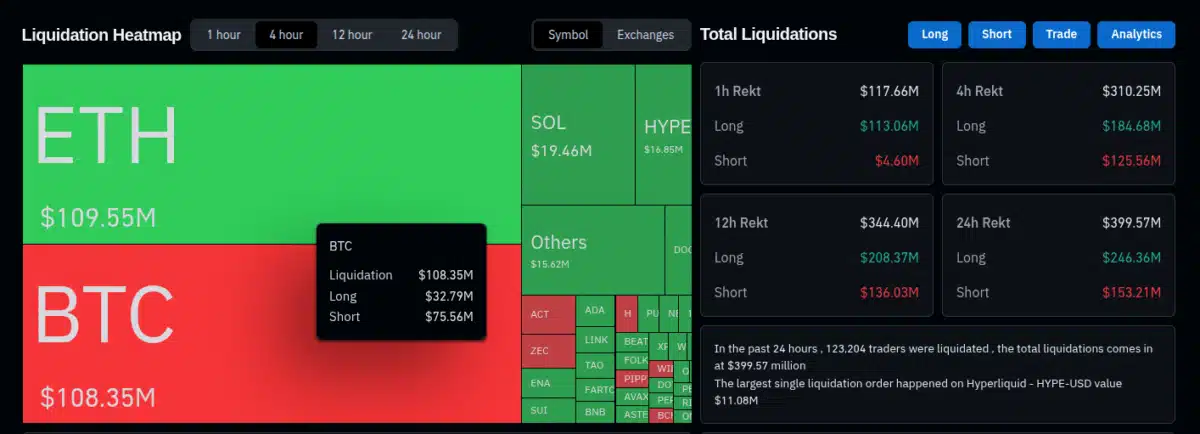

The latest wave of volatility hit traders hard. Over the past 24 hours, more than 120,000 positions were liquidated. Total losses came close to $400M.

Most of that damage happened fast. More than $340M in liquidations occurred in the last 12 hours alone. Around $310M of that came within a single four-hour window.

That timing matches the quick pump and dump that several analysts flagged during the session.

Looking only at Bitcoin, liquidations reached about $108M over four hours, based on data from CoinGlass. Roughly $75M of those losses came from short positions. Another $32M came from longs.

Ethereum saw liquidations on a similar scale during the same period. But the structure was different.

Most of the losses in ETH came from long positions, pointing to a clearer long-squeeze in Ethereum markets.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

The post Bitcoin Price Prediction: Why Did BTC Trigger Back-to-Back Short and Long Squeezes in a Single Session? appeared first on 99Bitcoins.