BitMine Immersion Technologies added more ethereum last week, even though its existing stash sits deep in the red. ETH slid to around $2,280 (-2.5%), well below the company’s average entry price. This move lands as crypto markets wobble, with investors rushing to cash and gold.

On paper, BitMine is down over $6 billion on its ETH position. That sounds reckless. Or it sounds like long-term conviction. The difference matters for your money.

BREAKING: BitMine's, $BMNR, unrealized ETH losses rise to -$6.6 billion, now on track to become the 5th largest documented principal trading loss in history if sold.

Unrealized losses are now at ~66% of the size of Archegos in 2021, the largest loss ever recorded. pic.twitter.com/JLHqMDLL1M

— The Kobeissi Letter (@KobeissiLetter) February 2, 2026

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Why Would Bitmine Buy ETH While Losing Billions?

BitMine runs an Ethereum treasury strategy. Think of it like a company choosing to hold gold bars instead of dollars. In this case, the “gold” is ETH.

Last week, BitMine picked up 41,788 ETH, pushing its total holdings above 4.2 million tokens. The firm started buying in June when ETH traded near $2,480. Today’s price sits lower, which means every new buy averages down the cost.

This mirrors what Michael Saylor did with Bitcoin years ago. Buy during pain. Hold through noise. Bet that the asset matters long term.

Ethereum’s Price is Falling, But Usage Tells a Different Story

ETH has dropped by more than 18% over the past week. That feels like danger. Price drops hurt. Fast.

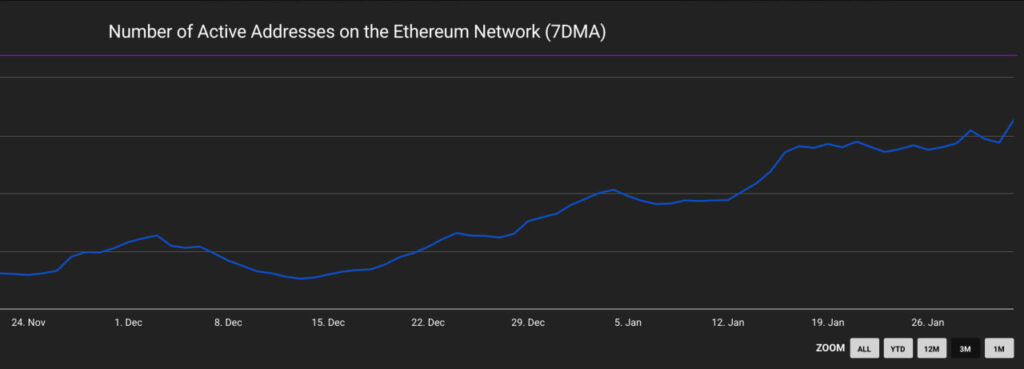

But Tom Lee points to something most people miss. On-chain activity keeps climbing. That means more transactions and more active wallets. Think of it like a highway. Even if toll prices fall, traffic keeps growing.

(Source: Number of Active Addresses on the Ethereum Network / The Block)

During past crypto winters, usage dried up. This time, it hasn’t. That’s why BitMine frames the dip as a reset, not a collapse.

We covered the Ethereum price decline earlier this month, and the same tension remains. Weak price. Strong usage.

DISCOVER: Top 20 Crypto to Buy in 2026

What this means for everyday investors watching ETH

BitMine’s bet sends a signal. Some institutions still see ETH as core financial plumbing, not a meme trade. Smart contracts, stablecoins, and DeFi apps still run on it.

That does not mean the price will rebound tomorrow. Bitcoin just dipped below $74,000, dragging the market with it. Risk-off behavior rules right now.

(Source: ETHUSD / TradingView)

If you’re new, here’s the translation. Big players’ buying does not cancel volatility. It only shows the time horizon. BitMine can wait years. Can you?

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post BitMine Buys More ETH While Sitting on a $6B Paper Loss appeared first on 99Bitcoins.