BitMine hit a major milestone after a three-week staking spree of more than 1 million ETH

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

, according to on-chain data tracker, @lookonchain. The Tom Lee-headed DAT (Digital Asset Treasury) has continued its Ethereum yield strategy with another 109,504 ETH being staked as of this morning (January 12).

In the past three weeks, Bitmine has staked over $3.7Bn in Ethereum. At a current staking APY of 2.81%, BitMine is projected to earn approximately $103M in Ethereum yield rewards annually.

Tom Lee(@fundstrat)'s #Bitmine staked another 109,504 $ETH($340.6M) in the past 2 hours.

In total, #Bitmine has now staked 1,190,016 $ETH($3.7B).https://t.co/P684j5YQaG pic.twitter.com/HHUI11YsT7

— Lookonchain (@lookonchain) January 12, 2026

This move is significant because it indicates that Ethereum no longer relies on mining. It operates on a staking model, converting idle ETH into a digital bond. For everyday investors, this raises a simple question. Is Ethereum becoming the go-to yield-bearing asset for institutions?

ETH USD has held steady over the weekend and is trading up +0.5% as news spreads, suggesting the market has already priced in increased institutional demand. This aligns with a broader trend in which large firms now treat ETH less as a tradable asset and more as a yield-producing asset.

What Does Bitmine Staking Over 1M ETH Actually Mean for the Ethereum Price?

While staking can sound intimidating and overly technical to those unfamiliar with blockchain technology, the concept is relatively simple. You lock up ETH to help run and secure the Ethereum network, and the network pays you for it.

Think of it like putting cash into a high-yield savings account. You cannot touch it for a while, but you earn interest for helping the bank operate. In Ethereum’s case, that ‘bank’ is the blockchain itself.

According to Arkham Intelligence, BitMine has now staked a total of 1,190,016 ETH, valued at approximately $3.7Bn at Ethereum’s current price of $3,100.

BitMine locked up 109,000 ETH this morning, underscoring the firm’s commitment to Ethereum’s mainstream adoption. In 2025, BitMine Chair Tom Lee announced that the firm has a long-term goal of acquiring and staking 5% of Ethereum’s total supply.

As of right now, BitMine holds just over 4.1M ETH, worth around $12.8Bn, and accounting for 3.433% of the total Ethereum supply. With the firm less than 1.6% away from its 5% goal, it is reasonable to expect this target will be met sometime in 2026.

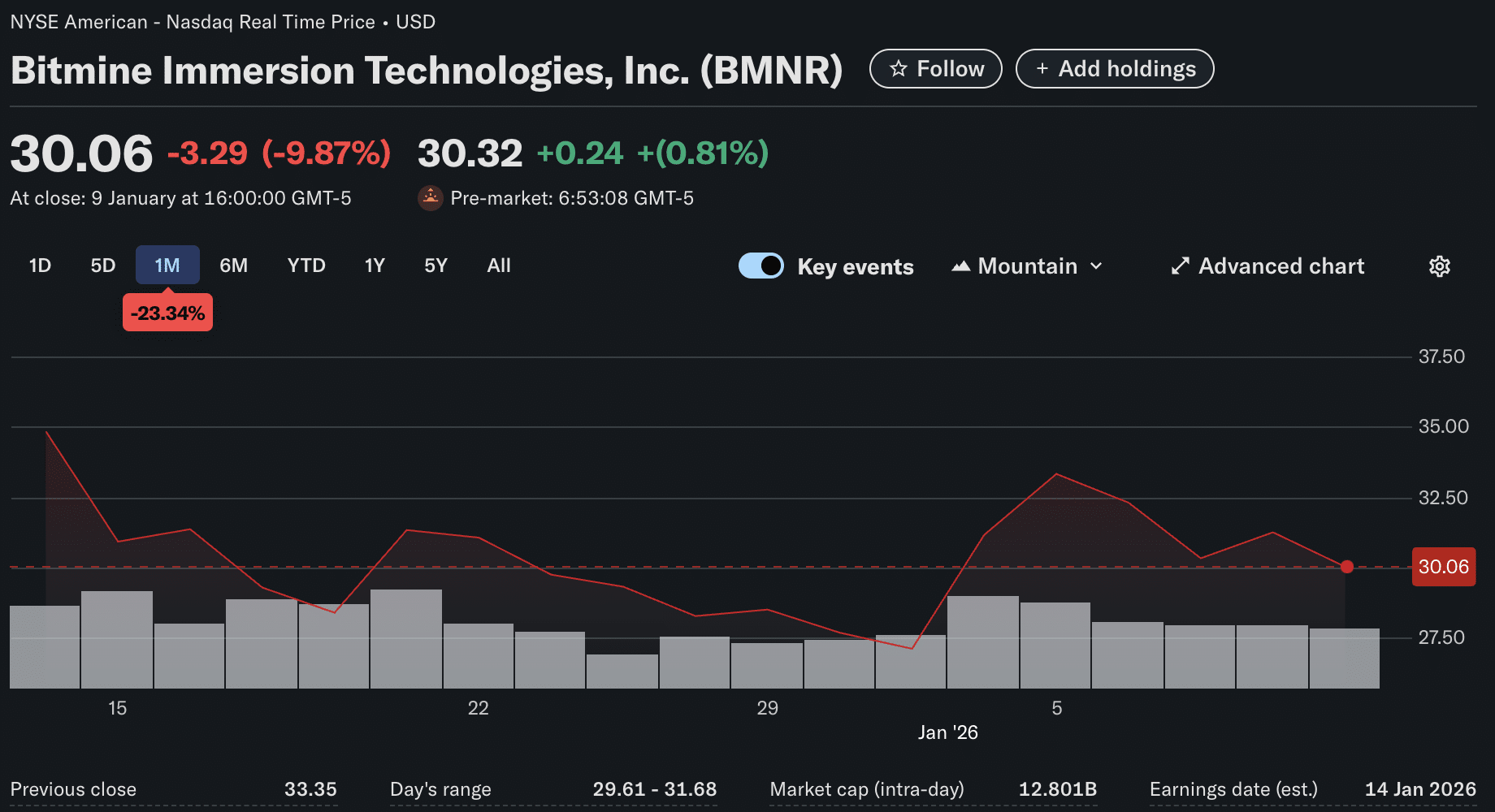

Although BitMine is in the headlines for all the right reasons at the moment, its BMNR share price has fallen -23.734% over the past 30 days, according to Yahoo Finance data.

Keen investors will be watching for the share’s movements when the US markets open later today, with many hoping for a green day following the Ethereum yield news.

(SOURCE: Yahoo Finance)

DISCOVER: 12 New and Upcoming Coinbase Listings to Watch in 2026

Institutional ETH Staking Moves Into the Mainstream as Ethereum Yield Becomes the Big Play

BitMine now sits among a growing group of firms that use Ethereum as a treasury asset, not just a speculative bet. The company now holds more than 4M ETH overall and has reiterated its long-term goal of owning a meaningful share of the total Ethereum supply.

This mirrors moves from other players. Grayscale recently started distributing staking rewards to investors, a first for US-listed ETH products, which I reported on just last week, here. That sends a clear message. Institutions now expect yield, not just price upside for Ethereum.

We have seen this play out before. Bonds replaced cash. Dividend stocks replaced idle capital. Ethereum is now playing that role in crypto and even outshines Bitcoin, the leading digital asset, which offers no yield to investors due to its lack of a staking protocol.

If you want a broader example, SharpLink’s recent ETH staking strategy showed how firms turn locked ETH into predictable income. You can read more about institutional ETH staking here.

Why locking up ETH Changes Supply Dynamics and the Associated Risks

BlackRock files for Ethereum staking ETF – How is it different from Grayscale's Staking ETP?

If you remember, Grayscale launched the $ETH Staking ETP back in early October 2025, and that news came right near the peak of the ETH chart (chart image)

– In fact, Grayscale's ETH… pic.twitter.com/TAgFUfQWDJ

— David Arnal (@davidarngar) December 9, 2025

Here is the quiet part beginners often miss. Staked ETH cannot be sold quickly. When companies stake millions of ETH for that juicy Ethereum yield, that supply leaves the liquid market. Fewer coins sit on exchanges, which in turn tightens the available supply during demand spikes, thereby reducing selling pressure.

This is why large staking waves matter even when prices do not jump right away. They reshape the Ethereum floor over time. It also explains the growing staking queue, which now exceeds 1 million ETH in backlog. We covered that dynamic in our breakdown of the Ethereum staking backlog.

Large staking numbers can be reassuring, but they do not eliminate risk. BitMine’s stock still trades more than -80% below its peak after a brutal 2025 for crypto treasury companies.

Staked ETH also stays locked during stress. If markets crash, you cannot instantly sell due to a dynamic unlocking period. That makes staking safer for patient capital and stressful for short-term thinkers. This is the same rule we repeat often. Yield does not remove volatility, but it does reward patience.

Ethereum now sits at an interesting crossroads. As more ETH is locked for yield, the network looks less like a casino slot machine and more like digital infrastructure that pays dividends. For beginners, the lesson is simple. Understand staking before chasing it. And never lock money you might need access to in a pinch.

EXPLORE: 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post BitMine Locks Up 1M ETH: Why Institutions Want Ethereum Yield appeared first on 99Bitcoins.