Cardano (ADA) jumped about 7% in early Asian crypto trading as 2026 kicked off, while Bitcoin and Ethereum posted smaller gains. Bitcoin trades at $88 level with about 1% gain as Ethereum hovered above $3K with 1% rally, extending its slow recovery from December lows. This all happened as global stock markets and even gold moved higher, signaling that investors feel a bit braver about risk again.

Cardano, Bitcoin, and Ethereum are three different crypto in the same tech sector. Today, the whole sector is green, but one name (ADA) stands out with a bigger move. ADA outperformed major coins like Solana, XRP, and BNB, even as analysts warned that this still does not count as a full “altcoin season.”

Why Is Cardano Crypto Jumping While Bitcoin and Ethereum Just Drift Higher? Altcoin Season?

An “altcoin season” is when lots of smaller coins rise much faster than Bitcoin over several weeks. Right now, that is not happening. Analysts at B2BINPAY say money still prefers the “big, liquid” names like bitcoin and ether as investors start the year in “capital preservation mode.”

“Staking risks are real, but manageable with trusted providers.”

>Vitaliy Shtyrkin, CPO @B2BINPAY, via @nypost

Staking is no longer hype, it’s a long-term strategy.

Read more: https://t.co/aFhQ5grCuq pic.twitter.com/kji6Lzh6hx

— B2BINPAY (@B2BINPAY) September 19, 2025

Cardano comes into this move after a brutal 2025. ADA dropped about 60% from its highs last year, but still kept around 500 million ADA locked in its apps, which also shows that many long‑term holders HODL-ing. If you want a deeper look at that drawdown, we covered it in detail in our recent piece on Cardano’s 60% crash and 2026 outlook.

At the same time, Bitcoin and Ethereum are doing their own slow grind. We have been tracking this short‑term trend in our daily market coverage, including Bitcoin near $90K and Ethereum reclaiming $3K, and our New Year’s update on BTC holding $87K with ETH just under $3K. Prices now sit slightly above those levels, which signals that dip buyers quietly stepped back in after the holiday lull.

On‑chain and market reports show ADA whales accumulated 150–180 million ADA across mid‑ to late‑2025, and institutions sent about $73 million into ADA products in 2025, with some research assigning about 75% odds of a Cardano ETF approval in the future.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

What Does This Mean for Us Looking at ADA, BTC, ETH, and SOL?

A 7% pop in ADA, while bitcoin and Ethereum move 1%, tells you traders are taking selective risk. They are not throwing darts at every coin. They are picking projects where they see strong narratives in 2026.

For Cardano, those narratives include major upgrades like the Midnight privacy sidechain and the Ouroboros Leios upgrade, plus Hydra scaling work that aims to make the network faster and cheaper. These upgrades support a “rebound” story for ADA in early 2026, even though fundamentals like on‑chain activity still look mixed.

Charles Hoskinson on how Midnight can boost the $ADA ecosystem":If Midnight is like 25 cents, you could be looking at billions of dollars potentially in TVL from that side of the house into the ecosystem, which is Cardano DeFi as well."

[Source: @bigpeyYT] pic.twitter.com/k1KkwGwZPl— ALLINCRYPTO (@RealAllinCrypto) November 27, 2025

BTC and ETH, meanwhile, behave more like the “blue chips” of crypto. When analysts say flows favor “liquid majors,” they mean big pools of money prefer coins they can enter and exit quickly without moving the price too much. This is why many people start with Bitcoin or Ethereum before touching smaller altcoins.

Solana also joined today’s move higher, though without ADA’s pop. If you want to understand how SOL sometimes trades out of sync with its growing usage, check our explainer on Solana’s price vs. network activity. We also recently covered how ETF inflows interact with key Solana price levels, which gives context for any SOL rallies you see this year.

DISCOVER: 10+ Next Crypto to 100X In 2026

How Should You Think About the Risks Behind Today’s Green Numbers?

ADA’s 7% move looks exciting on a daily chart. On a one‑year chart, it still sits far below 2025 highs. Short‑term spikes often reflect traders reacting to thin liquidity and holiday positioning, not a guaranteed long‑term trend.

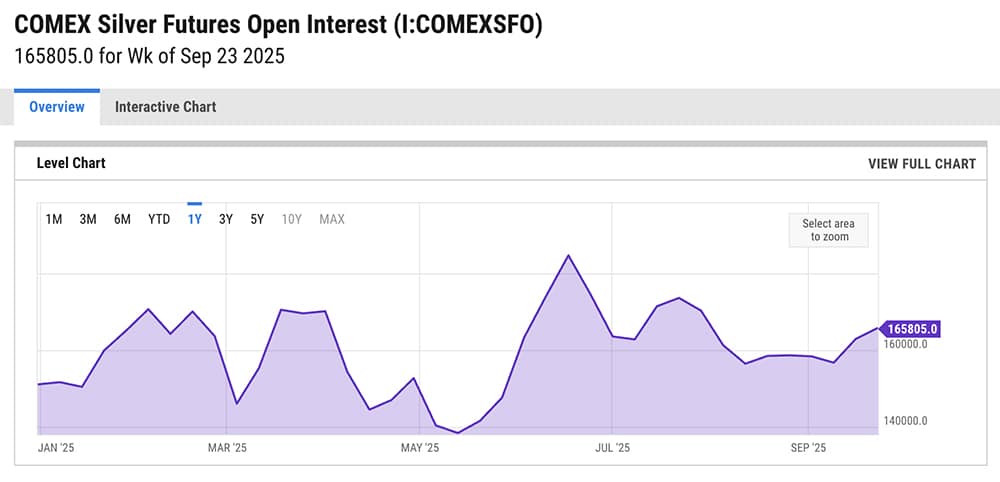

Analysts in traditional markets expect some near‑term selling as big funds rebalance after last year’s rally in assets like silver and gold. It is reported that as much as 13% of open interest in Comex silver may exit in the coming weeks. When big players reshuffle like this, it can ripple into crypto because many trade stocks, metals, and crypto as part of one global risk bucket.

(source – Ychart)

If you are thinking about buying ADA or any other coin because of today’s move, treat this as a signal to research, not a green light to ape in. High‑risk rule number one: never use rent money, emergency savings, or borrowed funds to chase a daily pump. A 7% up day can turn into a 15% down day just as quickly in altcoins.

The healthier way to approach this: decide whether you want long‑term exposure to large caps like BTC and ETH, then consider smaller positions in projects like ADA or SOL only after you understand what they do, how upgrades like Midnight and Hydra matter, and how much volatility you can stomach. If this quiet early‑2026 rally grows into something bigger, patient and educated buyers will feel much more comfortable than those who bought on impulse.

For now, Bitcoin holding the high $80,000s and Ethereum sitting above $3,000 suggests that crypto buyers have not gone away, and selective interest in Cardano hints at an early return of risk appetite. The next few weeks will show whether this stays a calm “majors and a few alts” story or evolves into a broader crypto run.

DISCOVER: Top 20 Crypto to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Cardano jumps 7% as 2026 Opens Its Crypto Chapter While BTC and ETH Quietly Grind Higher appeared first on 99Bitcoins.