Chainlink has launched a new feature that brings 24/5 on-chain pricing for U.S. stocks and exchange-traded funds, giving tokenized asset platforms access to more consistent and real-time data. The new streams are designed to support trading activity during extended market hours, filling a major gap for decentralized apps trying to mirror traditional markets more closely.

Around-the-Clock Pricing, Five Days a Week

The update provides data for U.S. equities and ETFs across the entire trading week, including pre-market and after-hours sessions.

JUST SHIPPED: Chainlink 24/5 U.S. Equities Streams brings the ~$80T U.S. equities market onchain.

Fast, secure stock & ETF data is now live across 40+ chains—24 hours a day, 5 days a week.

Trusted by @lighter_xyz, @BitMEX, @OfficialApeXdex, & more.

— Chainlink (@chainlink) January 20, 2026

Until now, most on-chain feeds only reflected prices during regular trading hours, which left tokenized stock platforms with stale or incomplete data when markets were still moving. With this new stream, developers and traders can keep apps responsive across the full market day.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in January2026

Powering More Responsive Apps

Protocols that deal with tokenized stocks or synthetic assets can now pull in price updates throughout the day without needing to rely on outside pricing tools.

That helps with everything from margin calculations to automated trading strategies. With more accurate pricing in off-hours, users can also react to news and market events without waiting for markets to reopen.

Trades Trigger the Updates

Rather than flooding the network with constant updates, the stream kicks in whenever trades occur. That means faster updates when markets are busy and fewer unnecessary updates during quiet periods.

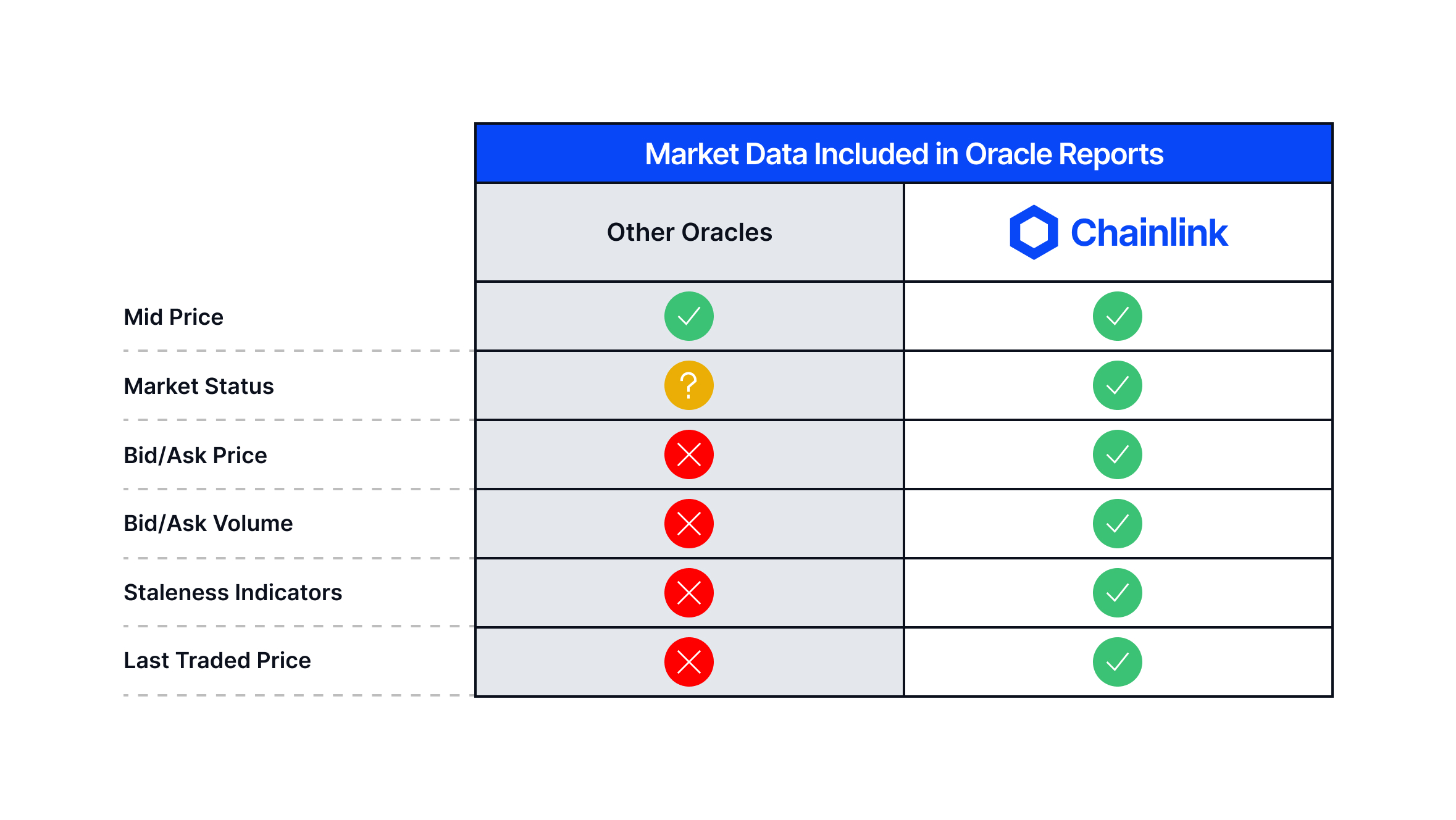

The feed also includes added context like spreads and market status, so apps can adjust how they behave when markets are thin or volatile.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Early Users Jump In

Derivatives platforms like Lighter and ApeX are already tapping into the new data. These exchanges are aiming to offer products like perpetual futures tied to real-world equities, and they need more than just closing prices to do that well.

By using the 24/5 stream, they can keep their markets in sync with real-world activity even after the stock market bell rings.

Making Tokenized Assets More Reliable

One of the biggest challenges for tokenized stocks has been keeping pricing in step with actual trading. Without real-time feeds, traders are flying blind during off-hours.

That creates risk and makes it harder to trust the products. This new data stream helps fix that problem, bringing more legitimacy and usability to the space.

Breaking Free from Wall Street Hours

Part of the goal here is to shake off the rigid hours of traditional exchanges. Crypto never closes, but tokenized stock trading has always been stuck with the old rules. With this update, on-chain markets get a little closer to offering true round-the-clock activity, at least five days a week.

More Room for Growth

There’s growing interest in turning real-world assets into blockchain-based products, and this type of infrastructure is a piece of that puzzle.

Traditional players are exploring 24/7 tokenized trading platforms, and if those systems need accurate pricing, Chainlink’s new feed could play a central role.

Eyes on the Next Update

Some developers are already thinking ahead. There’s interest in expanding the asset list, bringing in deeper metrics like order book data, and offering feeds for other markets entirely. For now, though, the 24/5 rollout is already changing how tokenized assets and on-chain finance handle live market data.

DISCOVER: 20+ Next Crypto to Explode in 2025

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!