Coinbase has formed the Independent Advisory Board on Quantum Computing and Blockchain, convening leading experts in quantum science, cryptography, and distributed systems, to evaluate risks from future quantum computers to blockchain security and provide independent guidance to the ecosystem. All to protect our assets as BTC USD is trading at $89K, holding its support. For now.

Announced on January 21, 2026, the board will publish position papers assessing quantum impacts, issue recommendations for developers, users, and institutions, and respond to major scientific advancements.

This forms part of Coinbase’s broader post-quantum security roadmap, which includes updating address handling, key management, and Bitcoin product enhancements to mitigate vulnerabilities.

JUST IN: Coinbase announces a new quantum computing advisory board

The board will:

– Publish position papers on the state of quantum computing

– Issue guidance to users, developers, and institutions

– Respond in real time to major quantum breakthroughs pic.twitter.com/eE8GqOVAiD— Bitcoin Archive (@BitcoinArchive) January 22, 2026

EXPLORE: Uranium Stocks Surge Under Trump: Best Investment Opportunity of 2026?

Is The Quantum Threat A Reality? Is BTC USD Price Affected?

The quantum threat stems from algorithms like Shor’s, which could efficiently break elliptic curve cryptography (ECDSA) and RSA used in Bitcoin and Ethereum signatures and keys. While large-scale fault-tolerant quantum computers remain years away, experts estimate no imminent risk, the “harvest now, decrypt later” strategy means encrypted data stolen today could be decrypted in the future.

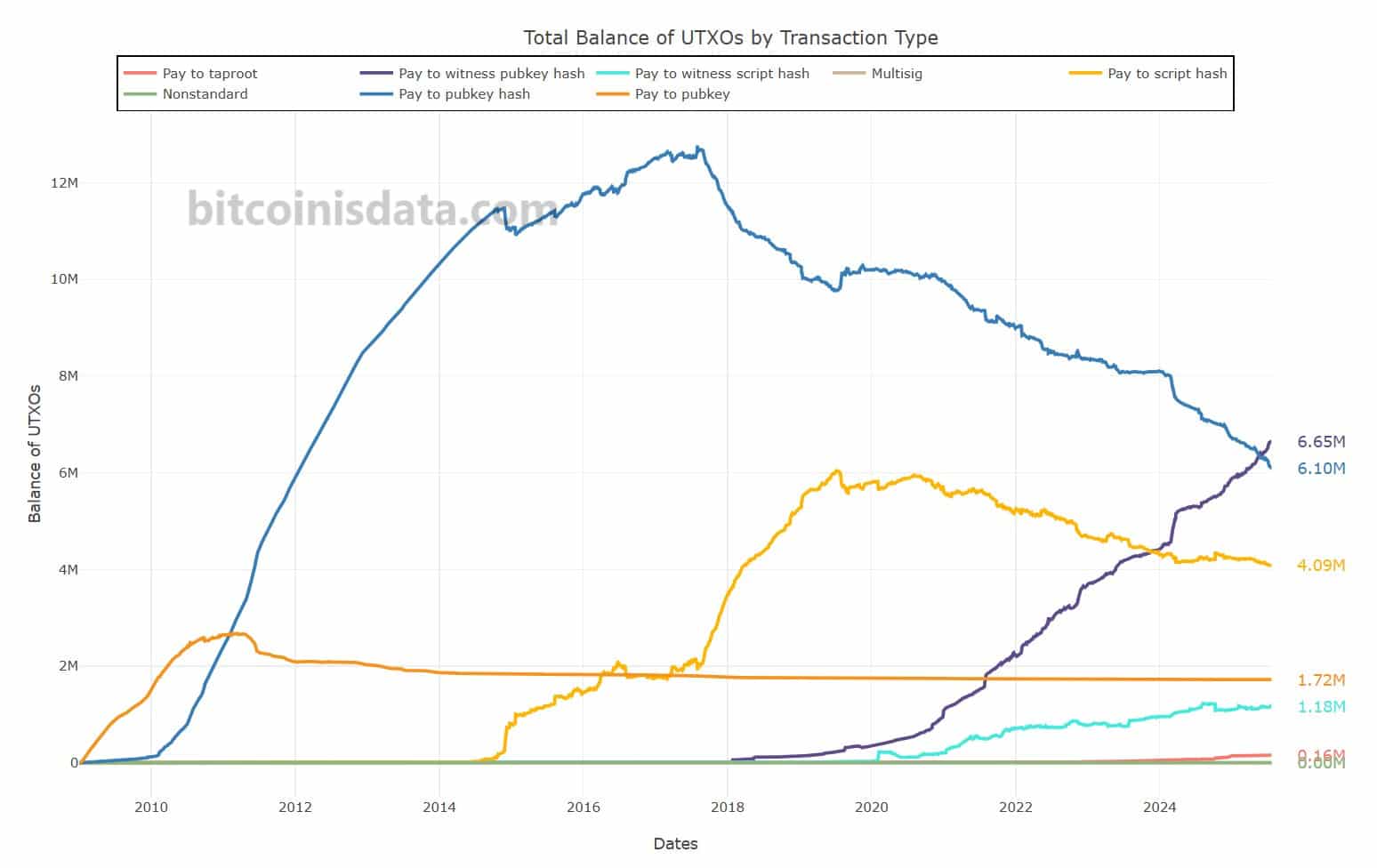

Coinbase Research notes that as of recent blocks, roughly 6.5–6.65 million BTC (about 32–33% of supply) in legacy addresses (P2PK, reused keys, certain multisig, Taproot) expose public keys on-chain, making them vulnerable to long-range quantum attacks. All outputs face short-range risks during spending, underscoring the need for migration to post-quantum signatures.

(Source: Bitcoinisdata)

Bitcoin is trading around $89,000. Prices consolidated after earlier volatility, holding key supports near $88,000–$90,000 while facing resistance at $95,000–$98,000. Institutional inflows into BTC ETFs continued strongly, supporting long-term demand despite macro pressures.

Securing your cryptocurrency is a lifelong commitment, and over 6.65 million BTC sit in wallets that rely on older cryptography. That’s a lot of long‑term savings.

DISCOVER: Why is BNB Crypto Down Today? Trade War Fears and Regulatory Hangovers Spark 5% Sell-Off

Why Coinbase Is Taking This Seriously Now

Coinbase runs one of the largest crypto exchanges in the world. The company said it is already updating address handling and key management systems. It also plans to publish a full quantum risk paper by 2027.

In 2024, the U.S. government approved new post‑quantum cryptography standards. These standards now guide how banks and tech firms upgrade security.

Coinbase’s proactive stance aims to enable coordinated, gradual transitions, avoiding rushed network forks or wallet disruptions.

This connects to broader Ethereum security upgrades and other blockchain security developments.

The broader industry is advancing similar protections, with soft forks or layered solutions expected over the coming years to maintain cryptographic resilience.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Coinbase Prepares for Quantum Threat as BTC USD Security Debate Heats Up appeared first on 99Bitcoins.