Crypto market news today is full of bad news, with another major crash wiping out $120 billion from the market overnight. Bitcoin, which was chilling at $106,000 just a few days ago, has dropped all the way down to $86,000 in just 10 days.

Today we are seeing a huge hit, and it’s dragged the total market cap just above $3 trillion. The S&P 500 lost $1.5 trillion from its high, and there wasn’t even a major headline or news story to explain why.

It’s been a rough week both in stock and crypto. Things were pretty calm at first, but then came this massive crash, with altcoins taking a beating. Until today, major alts like Ethereum, Solana, and XRP have dropped by 20-50% since Trump’s inauguration. Bitcoin itself is down 16% since before the US president has his seat.

The market’s mood has shifted drastically in just a few days. Last week, everyone was bullish; now, it feels like most people are flipping to being bears.

Crypto Fear and Greed Chart

1y

1m

1w

24h

Will the painful weekend be extended, or is today the bottom?

Is This Crypto Crash the Market Maker’s Fault?

It seems like market makers are partly to blame here. After October’s flash crash, they pulled back and left liquidity way too thin. That made it easy for whales to come in and trigger a bunch of sell-offs, especially targeting stop losses below the $90,000 mark.

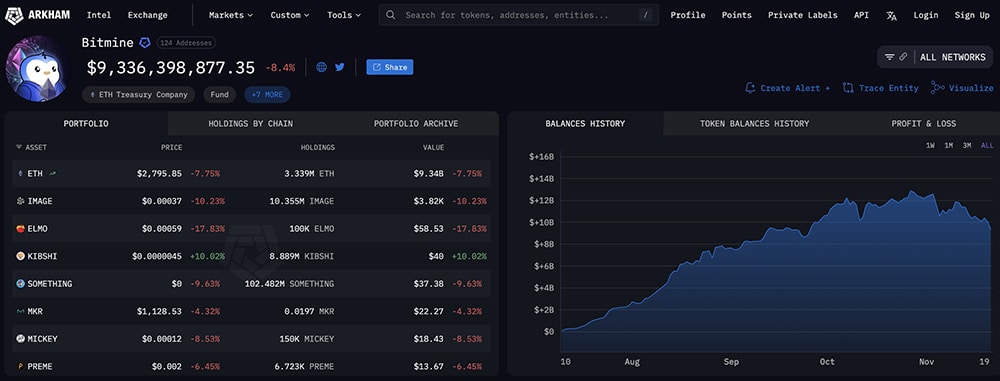

BitMine, the company run by Tom Lee, is one of the few staying strong in the face of this. Even with the market dipping, they’ve been buying more Ethereum, currently holding over 3.339 million ETH. Bitmine is sitting on a loss, but their mining operations and cash reserves should keep them afloat even with dropping prices. Lee’s still optimistic, believing Ethereum could go into a supercycle in the future.

(source – Arkham)

Right now, it feels like some kind of manipulation, as there hasn’t been any big news or event that would explain this massive price drop.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Is Trump’s Presidency to Blame for This Crash?

People are wondering if Trump’s presidency is playing a role in this recent crash. His policies definitely helped fuel some initial gains in the crypto market, but now we’re seeing the fallout from things like inflation fears and tariffs.

Ever since Trump took office:

• Bitcoin is down 25%⁰• Legit altcoins are down 50–90%⁰• Meme and junk coins? Basically wiped out

What a pro-crypto president, huh? pic.twitter.com/ehAQTltdBq— Crypto MARZEN (@CryptoMarzen) November 21, 2025

However, blaming him completely wouldn’t be fair. The wider market has been de-risking lately, and that’s definitely played a big role in this drop, along with ETF outflows.

MicroStrategy, the Bitcoin-bullish company led by Michael Saylor, isn’t backing down, though. Since they bought most of their Bitcoin below $40,000, they’re still sitting pretty with unrealized gains. Saylor says they can ride out any drops, even a 90% crash, without having to sell. Their strategy? Buy more Bitcoin, hold tight, and wait for 7 figure.

However, there’s a rumor that Strategy stock will be delisted from NASDAQ after dropping 57% from its peak.

BREAKING: Michael Saylor’s ‘Strategy’ stock set to be DELISTED from the Nasdaq 100 and MSCI USA.

The stock is deep underwater from its BTC investments, having dropped over -57% from its peak, and no longer meets the indexes’ minimum size and performance requirements. pic.twitter.com/WKTxeUrsIF

— SwanDesk (@SwanDesk) November 21, 2025

Metaplanet is also sticking to its guns, having raised funds to grow its Bitcoin treasury. Their approach seems to be all about holding steady through these tough times and expanding their position without panic selling.

Big and smart money is still holding their stack and adding.

DISCOVER: 10+ Next Crypto to 100X In 2025

Rounding Up Crypto Market News Today: Is This the Worst Q4 for Crypto Ever?

Looking at the data, this Q4 is down about 15%, making it one of the worst since 2018, the worst in 7 years. But that’s not the end of the world. Bitcoin has had worse quarters and still bounced back. There’s no sign of full capitulation yet, and long-term holders are still holding strong. This feels more like a healthy reset than the end of the bull market.

This is the worst Q4 we’ve seen in 7 years…

Absolutely insane. pic.twitter.com/fXfmUVfikB

— Mister Crypto (@misterrcrypto) November 19, 2025

A true bull run ending typically means investors lose all belief in the market, or there’s a major breakdown in the system. We’re not seeing those signs yet.

It’s not over, and we might soon see a parabolic altseason. Bitcoin is losing dominance, and many big players are quietly accumulating alts, rotating their Bitcoin gains. Some people think that this drop was actually needed to flush out the weak hands and set the stage for the next rally.

$BTC IS GOING TO $200,000

— Crypto GEMs

(@cryptogems555) November 19, 2025

The market might be manipulating itself, or maybe it’s just whales quietly setting themselves up for the next leg of the bull run. Either way, once liquidity returns, we could see things start to recover fast.

Don’t forget, summer’s just six months away, and when crypto turns around, it can happen quickly. Hold on tight. The storm might be almost over.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Will MicroStrategy Get Removed From Stock Indices if BTC USD Hits $75K?

The question on every investor’s mind right now is simple: if BTC USD continues to drop, will Strategy be kicked out of major stock indices? With Bitcoin sliding from six-figure euphoria to the high-$80Ks, and Michael Saylor’s Bitcoin-heavy corporate strategy under pressure, the debate has exploded across financial media.

And it’s a fair concern – MSTR has become a leveraged proxy for BTC price action, rising faster than Bitcoin on the way up and bleeding harder on the way down. However, despite market fears, a Bitcoin move to $75K wouldn’t automatically trigger index removal.

The reality is more nuanced, tied to market cap rankings, premium collapse, and looming index-provider reviews, rather than a single Bitcoin price threshold.

Read the full story here.

How Did ASTER Price React to New Coinbase Listing: New Web3 Wallet Next Coinbase Listing?

Are new Coinbase listings going to cut the wings of the ASTER price? This is what almost every trader is debating over the timeline right now, with one of the few projects performing positively in this bloodbath over the past week.

Many believe this is the top signal, and others think this will further boost the visibility and liquidity for the ASTER token. Without further ado, let’s look at some metrics and assess how the project is going.

Read the full story here.

The post Crypto Market News Today, November 21: Another Crypto Crash Wipes Out $120 Billion, Saylor’s Strategy Might Be Delisted appeared first on 99Bitcoins.