Vitalik Buterin might have just killed the Ethereum price and L2 market. Buterin announced this week that “The original vision for L2s and their role in Ethereum no longer makes sense.”

The idea in 2021 was that L2s would eventually become decentralized, but they haven’t really accomplished that. It may not even be possible.

But Ethereum’s problems are worse than that. The joke circulating is that a McChicken held since 2020 outperformed ETH. While other tokens hit new highs, Ethereum’s stuck below its 2021 peak. Something broke.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2026

Is Ethereum Worth Buying Anymore in 2026? Does Vitalik Offload Tons of ETH

The turning point is cost. After upgrades like Dencun, average transaction fees on Ethereum have fallen to pennies, often under $0.01. With further gas limit increases expected this year, the original pitch for L2s as cost-saving “branded shards” has weakened.

At the same time, decentralization on many L2s has stalled. Some teams have paused progress for regulatory or commercial reasons, undermining the idea that they cleanly inherit Ethereum’s security.

If you held the McChicken for the past 5 years, you would have outperformed Ethereum. pic.twitter.com/u6AYm1yX7i

— Uzi (@UziCryptoo) January 31, 2026

Meanwhile, Vitalik dumped 1,441 ETH, $3.3 Mn, over the past two days. On-chain data caught it, yet speculation points to donations that he made.

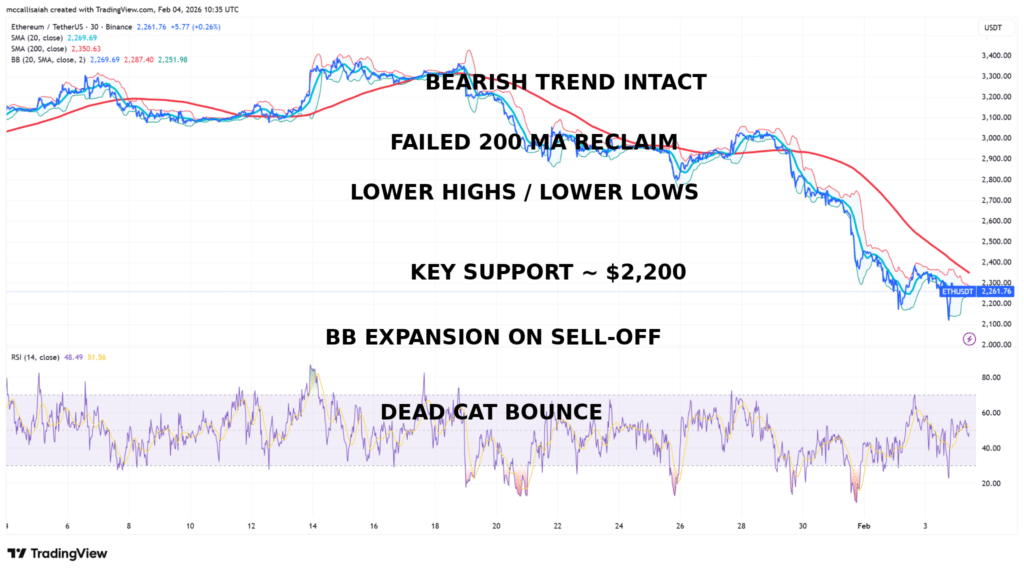

ETH’s chart is textbook bearish: lower highs, lower lows, each bounce weaker than the last. The recent rally looks like a dead cat bounce with support at $2,200, then $2,100.

Ethereum is still in sell-the-rips territory. Until price reclaims the 200 MA with conviction, this remains a bearish structure with downside risk still very real.

DISCOVER: 20+ Next Crypto to Explode in 2026

What Does the Data Says For Ethereum Price Right Now?

Many other metrics point to a bearish year for Ethereum:

- ETH supply increased 45,000 tokens monthly for the past 10 months through January 2025. The deflationary burn narrative is dead.

- Layer 2 activity surged but mainnet revenue collapsed.

Additionally, record transactions look suspicious, with 99Bitcoins analysts flagging many spam attacks, not organic growth.

“Ethereum’s L2 roadmap is a catastrophic failure.” – Max Resnick, Lead Economist, Anza

TVL dominance dropped from 14.6% to 12.8% in late 2025. The fundamentals are rotting.

DISCOVER: Top 20 Crypto to Buy in 2026

What to Watch Next For ETH USD

Watch proposals around native rollup precompiles and gas limit increases. Track which L2s articulate clear guarantees versus vague scaling promises.

Ethereum is choosing settlement hardness over growth-at-any-cost, and that choice will reshape which networks survive the next cycle.

EXPLORE: King of The Decade? Analyst says Bitcoin Price Returns Will Beat Gold and Silver

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

Key Takeaways

- Vitalik Buterin just admitted the plan failed. He announced the L2 strategy is dead and the Ethereum price tanked.

- ETH supply increased 45,000 tokens monthly for the past 10 months through January 2025. The deflationary burn narrative is dead.

The post Ethereum Is Dying, Or Is This the Biggest Buy Signal of the Decade? appeared first on 99Bitcoins.