Grayscale’s plan to launch the first US Zcash ETF could bring one of crypto’s most privacy-driven assets into Wall Street’s main spotlight.

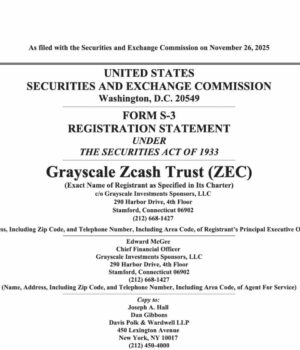

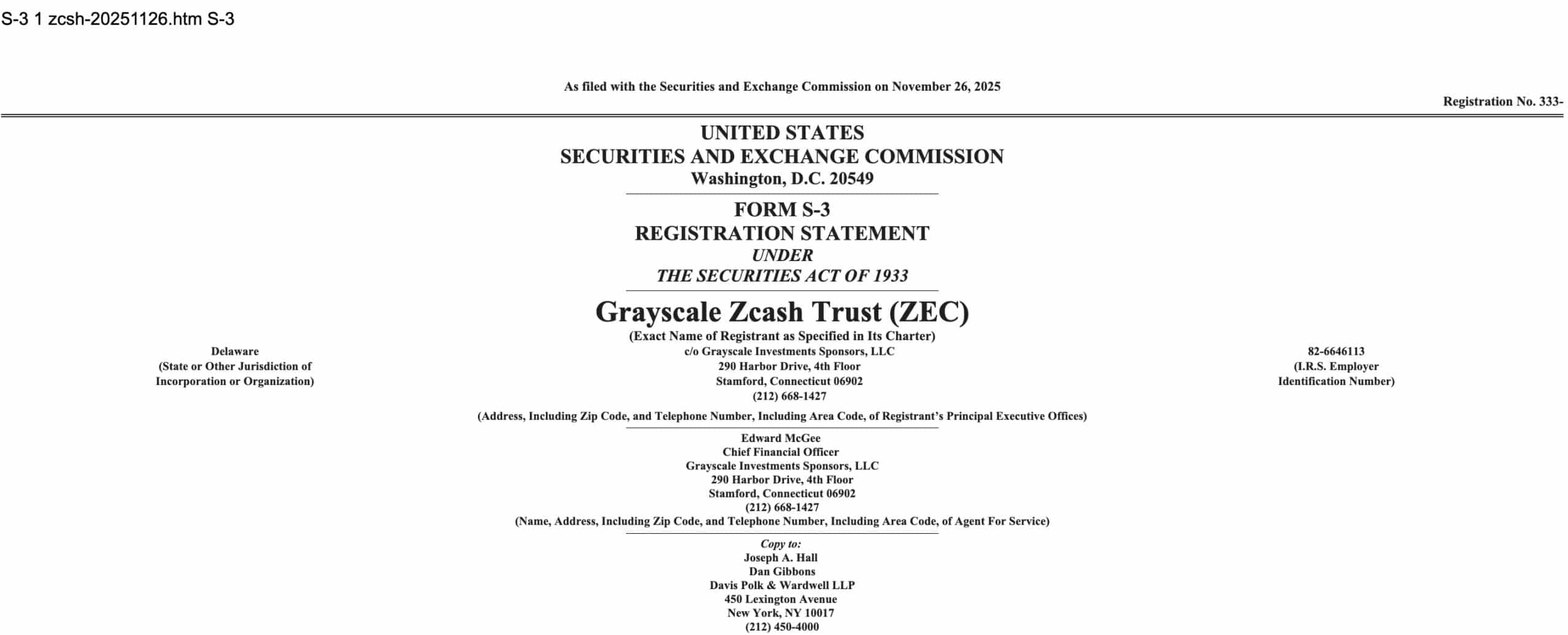

The firm filed a Form S-3 with the US Securities and Exchange Commission on Wednesday, November 26, asking to convert the Grayscale Zcash Trust into an exchange-traded fund.

If approved, the product would trade on NYSE Arca under the ticker ZCSH.

According to the preliminary prospectus, the ETF would track CoinDesk’s Zcash Price Index (ZCX).

Coinbase Custody would hold the underlying asset, Coinbase, Inc. would act as prime broker, and BNY Mellon would serve as transfer agent and administrator.

DISCOVER: Zcash (ZEC) Price Prediction 2025-2040

What Would the Grayscale Zcash Trust ETF Look Like After Conversion?

The goal is simple: give investors regulated, exchange-traded access to ZEC, a cryptocurrency built around privacy.

The filing comes after a tough year for ZEC. The token has made a sharp comeback in recent weeks. The new ETF push lands at a time when interest in privacy-focused transactions is picking up again. CoinDesk noted that Grayscale moved to convert its long-running trust into a spot ETF as ZEC posted some of the strongest gains of 2025.

At press time, ZEC traded near $513, showing an increase of about +5% and moving between roughly $488 and $526 over the past 24 hours.

In the filing, Grayscale states it will rename the product Grayscale Zcsh Trust ETF once regulators approve the conversion.

The documents also note that creations and redemptions are limited to cash for now. In-kind activity may require further steps from the exchange, and there’s no clear timeline for when those changes might be allowed.

On November 25, the trust held about 394,400 ZEC, worth roughly $199M based on prices at that time. That figure offers an early look at how the ETF could be seeded if the conversation moves forward.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What Do Cash and In-Kind Creations Mean for ZCash Investors?

The ETF aims for its share price to track the value of the trust’s ZEC holdings, minus fees, using the ZCX index as a benchmark. New shares and redemptions would begin in blocks of 10,000, with cash orders handled by a liquidity provider.

Regulators must grant NYSE Arca the required in-kind approval before it can add in-kind creations.

Analysts say the move reflects ZEC’s renewed momentum and the significance of seeing a US-listed spot product tied to a privacy coin, a corner of the market often squeezed by AML rules and delistings.

The prospectus spells out the plan clearly. The Trust “intends to list the Shares on NYSE Arca… under the symbol ‘ZCSH’” and will switch to the “Grayscale Zcash Trust ETF” name once the filing takes effect.

From here, the SEC still has to review the S-3. The exchange listing process and any extra approvals for in-kind creations and redemptions also remain open questions.

You should keep an eye on updated prospectus amendments, any new moves from NYSE Arca, and how EU anti–money laundering rules roll out.

Together, these factors will decide whether this moment becomes a real shift for regulated Zcash exposure or the last big step before tighter rules start to bite.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

The post Is Grayscale ZEC ETF Proposal the Beginning of the End for a Free ZCash? appeared first on 99Bitcoins.