Japan is preparing to overhaul its crypto tax system after more than a decade of investor complaints and industry lobbying. According to new reporting from Nikkei Asia, the government and ruling coalition have formally endorsed a plan to cut the nation’s maximum crypto tax rate to a flat 20%, aligning digital assets with equities and investment trusts.

The Financial Services Agency (FSA) is expected to introduce the crypto bill during the regular Diet session in early 2026.

The decision marks one of the most consequential shifts in Japan’s digital-asset policy since the collapse of Mt. Gox in 2014. It also reflects a growing political will to revitalize Japan’s stagnant cryptocurrency sector, which has been hindered for years by punitive tax rules.

DISCOVER: 20+ Next Crypto to Explode in 2025

Why Is Japan Anti-Crypto? Could the 20% Tax Fix Be a Fix?

Crypto Fear and Greed Chart

1y

1m

1w

24h

Japan’s current rules treat crypto earnings as “miscellaneous income,” a category that drags traders and businesses into steep progressive tax brackets. The result has been predictable with stiff penalties on gains, muted domestic participation, and a steady flow of talent and capital toward friendlier jurisdictions.

All of this comes as

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

0.89%

Bitcoin

BTC

Price

$86,638.22

0.89% /24h

Volume in 24h

$48.83B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

is crashing and the Japan carry-trade is dying. The carry trade was built on arbitrage: you could borrow $1 Mn in Yen, pay back 1%, buy Bitcoin that was appreciating at 4%, and pocket the spread.

$BTC dumped cause BOJ put Dec rate hike in play. USDJPY 155-160 makes BOJ hawkish. pic.twitter.com/lG47l5cbCA

— Arthur Hayes (@CryptoHayes) December 1, 2025

By contrast, gains from equities and investment funds are taxed separately at a steady 20%. This inequality has driven traders offshore, reduced domestic liquidity, and deterred startups from establishing Web3 businesses within Japan.

Will Japan Always Be Against Crypto? (What’s Next for BTC)

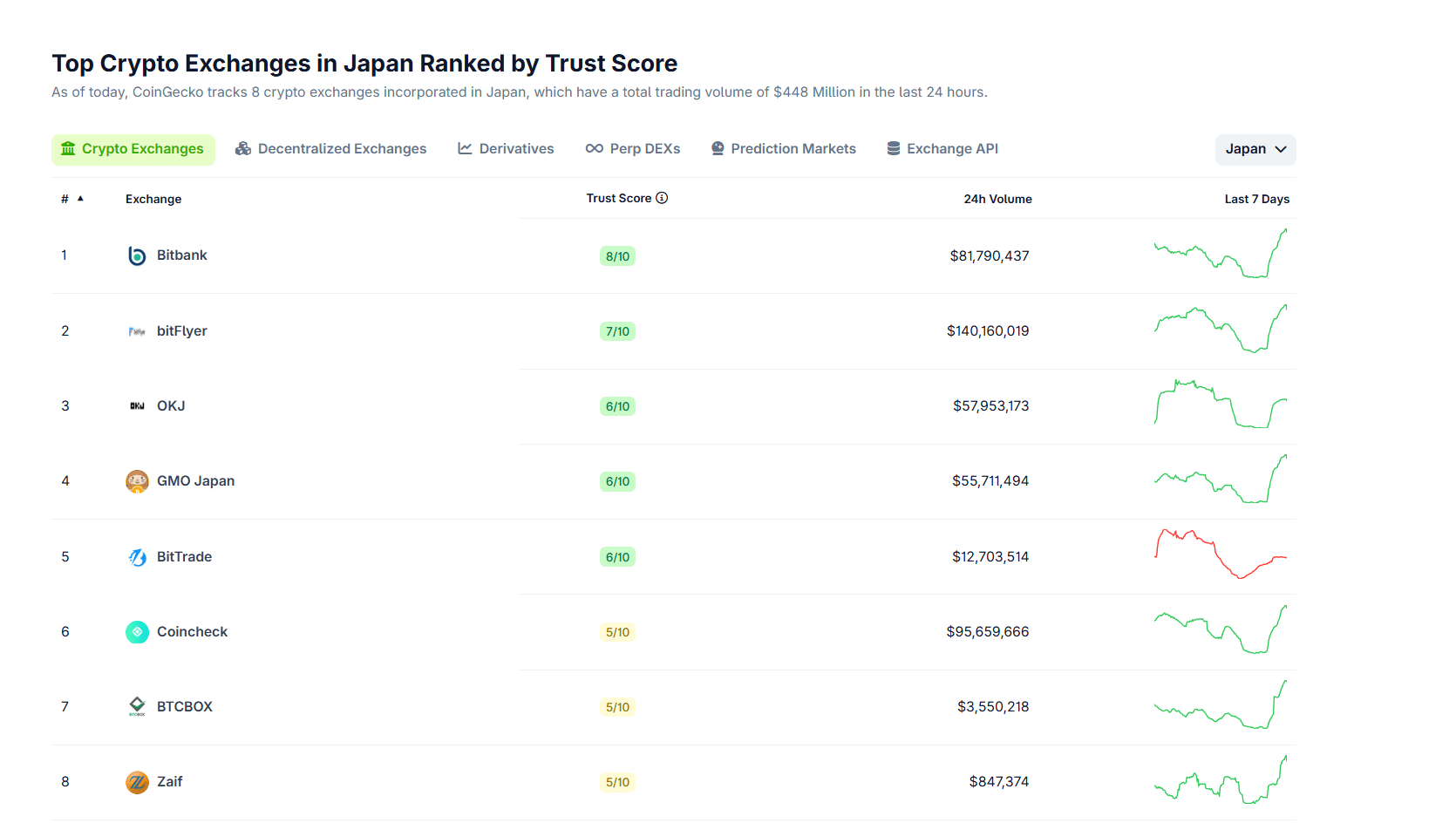

Japan’s crypto activity has trailed global momentum for two years. CoinGecko data shows that local exchange volumes consistently underperform those of major hubs like the US and South Korea, while DeFi Llama’s Japan-linked stablecoin flow metrics indicate weaker capital rotation, even during broad market rallies.

A flat 20 percent tax could flip that script. Domestic brokerages estimate that a unified rate would increase spot-trading participation by 20 to 30% over the next two years, as retail traders return and institutions finally receive the clarity they’ve been waiting for.

FRED data adds another layer, showing that Japanese households still park more than half of their wealth in low-yield cash deposits. A streamlined crypto tax code would give them a clear pathway to redeploy some of that dormant capital back into risk assets.

FSA Seeks Balance: Lower Taxes, Higher Oversight

The Japan Blockchain Association has spent almost three years calling for a 20% flat tax. While the FSA has not confirmed direct influence from lobbying efforts, the timeline indicates that the agency began warming to tax reform discussions in September 2024.

Regardless of the cause, the shift signals a major victory for Japanese crypto advocates, who have long argued that the nation’s tax code hinders innovation abroad.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Japan is preparing to overhaul its crypto tax system after more than a decade of investor complaints and industry lobbying.

- The shift signals a major victory for Japanese crypto advocates who have long argued that the nation’s tax code drives innovation abroad.

The post Japan Crypto Moves Toward Flat 20% Crypto Tax as Government Backs Major Reform appeared first on 99Bitcoins.