Pump.fun executives and related Solana figures reportedly face a new lawsuit that claims more than 5,000 internal messages prove coordinated market rigging on the platform. SOL traded under pressure as traders weighed the legal risk to Solana’s meme-coin scene, already linked to huge scam losses in 2024. This case lands on top of growing regulatory heat on high-speed, low-fee chains that attract both serious builders and professional scammers.

Prosecuting lawyers allege that over 5,000 private messages were exchanged between Solana Labs and Pump.Fun engineers discussing manipulation of coin launches and other insider schemes.

I am being threatened with rape and murder for representing my clients.

We are documenting each of these threats and will address them through the appropriate legal channels.

Threats of violence will not stop us from fulfilling our ethical duties as attorneys or from continuing…

— Max Burwick (@burwick_max) December 18, 2025

What is Pump.fun and Why Are Solana Meme Coins Back in Court?

Pump.fun is a Solana-based tool that lets anyone spin up a meme coin in minutes. Think of it like a “token vending machine” where you insert a meme and out pops a tradable coin, typically tied to a simple pricing rule known as a bonding curve. That speed and ease attracted a wave of degens hunting 100x gains and a tidal wave of scammers.

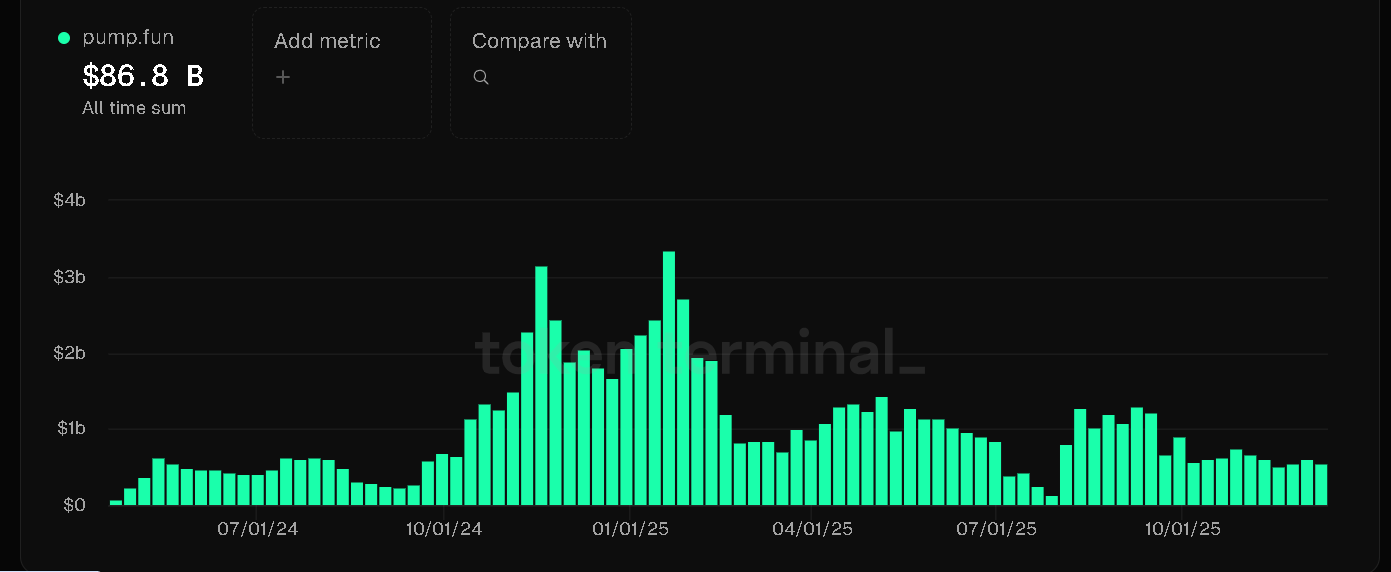

(Source – Pump.Fun Volumes, Token Terminal)

According to Solidus Labs data via CoinDesk, 98.6% of tokens launched on Pump.fun showed rug-pull behavior. A rug pull refers to the creator withdrawing liquidity or dumping on buyers, much like a street vendor who takes your cash and runs before handing over the goods. That track record has already put the platform under a harsh spotlight.

The new lawsuit reportedly leans on around 5,000 messages to argue that insiders not only tolerated that behavior but also helped rig markets. Pump.fun already faced legal pressure before this, including a January 2025 case accusing it of operating as an unregistered securities exchange, per court summaries on Wikipedia. This is not a one-off complaint—it appears to be a trend.

This story also fits a pattern that is prevalent across the crypto industry. Past Solana insider-trading allegations and even market manipulation claims surrounding XRP demonstrate that regulators now scrutinize any hint that insiders may stack the deck against retail traders.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

How Risky Are Solana Meme Coins for Everyday Traders?

Solana’s key selling points are speed and low fees. That makes it feel like a crypto arcade—cheap, fast, and fun. The downside: scammers love those same features. According to CoinDesk, Solana-based rug pulls resulted in the loss of around $500 million in 2024 alone.

Even outside Pump.fun, risk runs high. On Solana DEXs (decentralized exchanges—think “crypto vending machines” with no central cashier), like Raydium, one report found 93% of pools showed soft-rug traits. A soft rug is when liquidity slowly drains and the project quietly dies, instead of an instant smash-and-grab. The result feels similar for you: bags that fade toward zero.

So what does this lawsuit change for your wallet? It tells you that regulators now treat meme-coin launchpads like real financial platforms, not cute internet casinos. If courts find proof of rigging, we will likely see stricter rules, forced KYC, or outright shutdowns of the wildest venues. That hits anyone who chases early launches without understanding the plumbing.

This also matters for broader Solana confidence. Legal battles stack on top of technical stress and past security scares, like the bonding-curve exploit Pump.fun suffered in 2024 that cost users around $300,000, as CoinDesk reported. When headlines rhyme—exploits, rug statistics, then market-rigging lawsuits—newcomers start to treat the whole niche as a trap.

RELATED: Best Solana Meme Coins Right Now

What Should You Do if You Still Want to Trade Solana Meme Coins?

If you still feel tempted by Solana meme coins, treat them like a casino side bet, not an investment plan. Never use rent money, savings, or emergency funds. Only risk what you genuinely accept losing to zero. With data showing that more than 9 out of 10 tokens on some venues behave as rug pulls, you need to assume the odds are stacked against you from the start.

Second, size down and slow down. If you must speculate, consider using tiny position sizes, spread bets across multiple projects, and avoid chasing coins that launched in the last few minutes. Early buyers often sit in prime position to dump on late entrants. Always check liquidity, contract ownership, and whether liquidity is locked before you touch a chart. Our guides on rug pulls and scam spotting on 99Bitcoins give you step-by-step checks you can run in a few minutes.

Third, understand that regulation hits hardest at the edges. When authorities press cases like this, they rarely stop with one platform. They create templates that can be extended to other meme-coin launchpads and high-risk DeFi tools. For a bigger-picture view of how rule changes spread, see our coverage of evolving US crypto regulation.

As this lawsuit progresses through the courts, expect increased scrutiny, more headlines, and possibly further platform changes on Solana. If you focus on education first and keep your risk minimal, you can watch the drama without putting your financial future at risk.

DISCOVER: 10+ Next Crypto to 100X In 2025

The post Pump.fun Lawsuit Alleges 5,000-Message Plot to Rig Solana Meme Coins appeared first on 99Bitcoins.