The SEC and the CFTC announced they will work more closely to regulate crypto markets. Bitcoin stayed near its recent range after the news, suggesting traders saw it as a background change rather than something to trade on right away.

It also aligns with a broader US move toward clearer rules rather than sorting things out through court cases.

What the SEC and CFTC Actually Announced

In simple terms, the two main market regulators in the US agreed to communicate more and plan together.

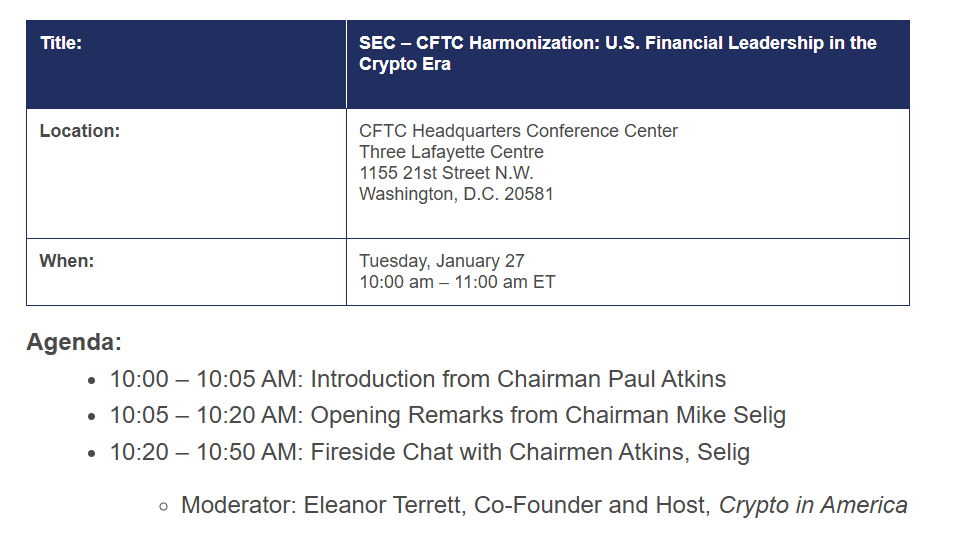

The Securities and Exchange Commission, which looks after stocks and other investments, and the Commodity Futures Trading Commission, which oversees things like gold and oil, said they will host a harmonization event and coordinate future steps on crypto oversight, according to the SEC.

NEXT WEEK: We are partnering with the @CFTC to hold a joint event on harmonization and U.S. financial leadership in the crypto era.

The event, held at CFTC headquarters, will be open to the public and livestreamed on our website.

— U.S. Securities and Exchange Commission (@SECGov) January 22, 2026

Crypto has sat between their responsibilities for years. That left exchanges and users unsure who was really in charge and this effort aims to reduce that guessing game.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in January2026

Why Clear Rules Help Everyday Users

When rules are fuzzy, platforms get cautious. Exchanges delay listing new coins. Apps limit features for US users. That usually affects beginners first, because options shrink and protections become harder to understand.

Working together helps cut through that confusion. In 2025, both agencies already said registered exchanges can support certain spot crypto products, according to a joint staff statement.

What This Says About the Direction in the US

The SEC also set up a dedicated crypto task force in 2025 to focus on writing clearer guidance instead of leaning on lawsuits. Markets tend to notice that kind of tone change.

This cooperation also supports bills like FIT21, which tries to spell out which types of crypto fall under which regulator. These kinds of laws sound dull, but they decide where exchanges can operate and what kind of help users get when problems show up.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Where the Risks Still Are

Even with better coordination, gaps remain. Former CFTC Chair Rostin Behnam said in early 2025 that the US still lacks full coverage for digital assets. That leaves space for scams and weak platforms to slip through.

For users, the basic safety rules stay the same. Stick to well-known exchanges. Be careful with offers that promise easy profits. Clearer oversight helps, but it does not replace common sense.

As regulators line up their approach, crypto starts to look less chaotic and more supervised. That kind of progress usually takes time to show up in prices, but it helps build the structure long-term users rely on.

DISCOVER: 20+ Next Crypto to Explode in 2025

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

The post SEC and CFTC Set to Work Together on Crypto Oversight appeared first on 99Bitcoins.