Solana and XRP ETFs extended their inflow streaks on November 14, while Bitcoin and Ethereum ETFs recorded their third and fourth consecutive days of outflows.

Summary

- Solana and XRP ETFs saw strong inflows as Bitcoin and Ethereum recorded continued redemptions.

- Bitcoin and Ethereum ETFs posted multi-day outflows with nearly $670M pulled on November 14.

- Solana kept its inflow momentum, while XRP ETFs saw a strong debut with $243M added.

Bitcoin (BTC) ETFs bled $492.11 million, and Ethereum (ETH) ETFs saw $177.90 million in redemptions. Solana (SOL) spot ETFs posted $12.04 million in net inflows on November 14.

XRP (XRP) ETFs recorded $243.05 million in net inflows on their second trading day after seeing zero flow activity on the November 13 listing day.

Bitcoin and Ethereum ETFs extend outflow streak

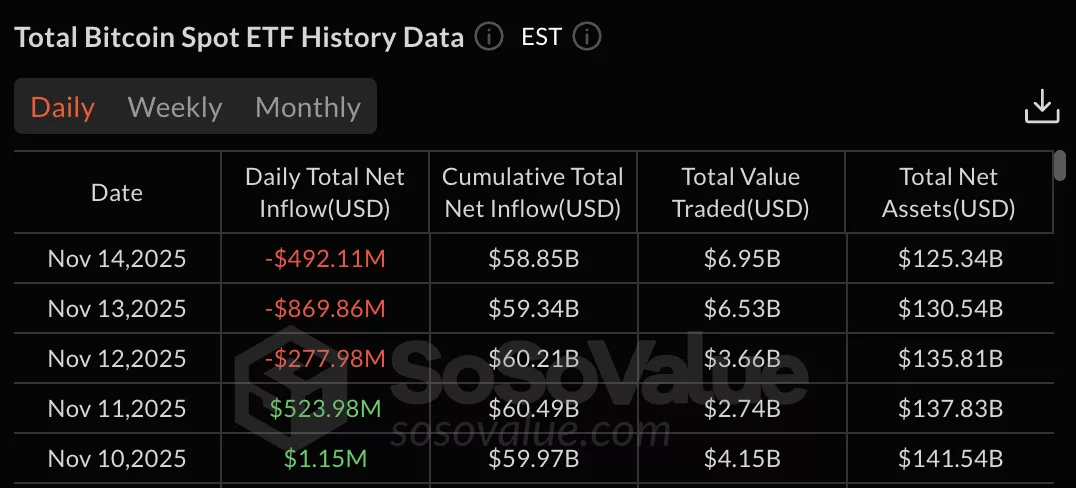

As per data from SoSo Value, Bitcoin spot ETFs have recorded three straight days of net outflows.

November 13 saw the largest single-day withdrawal at $869.86 million, followed by $492.11 million on November 14 and $277.98 million on November 12.

Prior to the outflow streak, Bitcoin ETFs posted $523.98 million in inflows on November 11 and $1.15 million on November 10.

Cumulative total net inflow across all Bitcoin ETFs stands at $58.85 billion. Total net assets under management reached $125.34 billion as of November 14.

Ethereum spot ETFs have seen four consecutive days of outflows. November 13 recorded the largest withdrawal at $259.72 million, followed by $183.77 million on November 12, $177.90 million on November 14, and $107.18 million on November 11.

Cumulative total net inflow for Ethereum ETFs stands at $13.13 billion. Total net assets under management reached $20.00 billion as of November 14. Total value traded hit $2.01 billion on November 14.

Solana maintains momentum, XRP ETFs sees strong debut

Solana spot ETFs have posted consistent inflows since late October. The funds recorded $12.04 million on November 14, $1.49 million on November 13, and $18.06 million on November 12.

Earlier in November, Solana ETFs attracted $7.98 million on November 11, $6.78 million on November 10, and $12.69 million on November 7.

Cumulative total net inflow reached $382.05 million. Total net assets under management hit $541.31 million.

XRP ETFs launched on November 13 with zero flow activity on the listing day. The funds saw $243.05 million in net inflows on November 14 through cash or in-kind creations. Total net assets reached $248.16 million after two trading days.