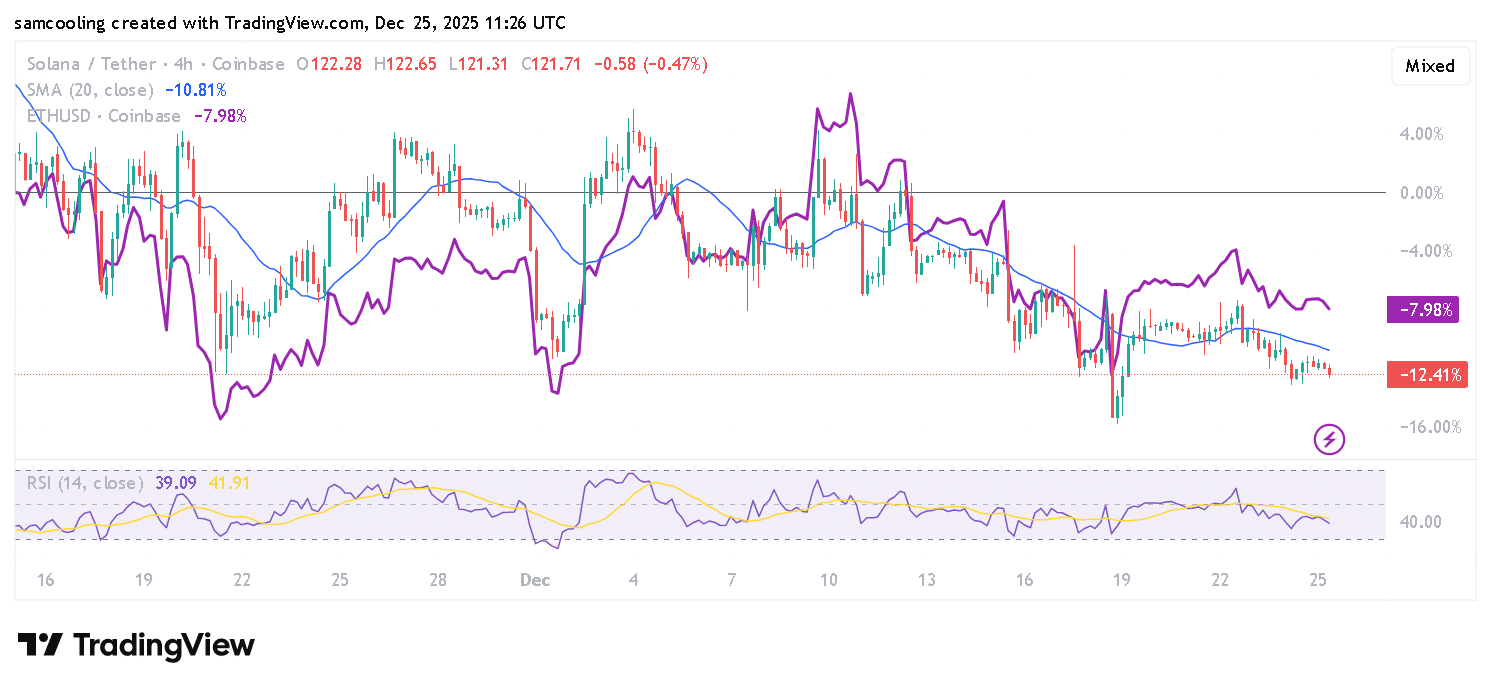

Venture firm Dragonfly says Ethereum and Solana will share, not fight over, the growing market for tokenized assets, arguing that “you can’t just have one blockchain.” ETH and SOL traded in a tight range after the comments, as both chains already attract heavy real-world asset and stablecoin activity. Behind this calm price action lies a fast-growing trend: tokenized assets have jumped past $23 billion in 2025, and major institutions are deciding where that money resides on-chain.

(Source – TradingView, SOL ETH)

Tokenization Race: What Does This Between Solana and Ethereum Actually Mean?

Think of tokenization as turning real-world stuff, like U.S. treasuries, stocks, or real estate, into digital receipts on a blockchain that you can trade 247. The value of these tokenized real-world assets grew to more than $23 billion in 2025, representing a 260% increase in a year. That is why everyone in crypto suddenly talks about “RWAs.”

Dragonfly general partner Rob Hadick told CNBC that Ethereum and Solana are “both Facebook,” meaning both can win big at the same time. Ethereum currently hosts most stablecoins and institutional products, such as BlackRock’s BUIDL tokenized fund on Ethereum, highlighted by Blockridge. Solana, meanwhile, processes huge trading volumes with low fees, making it attractive for high-speed trading activity.

RWA data platform RWA.XYZ shows Ethereum’s on-chain asset value, including stablecoins, at around $183.7 billion, compared to Solana’s $15.9 billion. Ethereum still appears to be the “Wall Street” of tokenization, while Solana serves as a cheaper and faster trading venue. That split helps explain why some apps move chains as their needs change, rather than relying on only one network.

(Source –RWA.xyz, Ethereum)

One example is fantasy sports platform Sorare, which spent six years on Ethereum before announcing a move to Solana to tap its speed and consumer-friendly user base. At the same time, other projects double down on Ethereum for regulatory comfort and deeper liquidity. This kind of chain-hopping shows you, as an investor, that the “which chain wins?” debate matters less than understanding what each chain does well.

DISCOVER: 20+ Next Crypto to Explode in 2025

How Could This Multi-Chain Future Affect Regular Crypto Investors?

Hadick argues that no single blockchain can scale enough to host all tokenized assets and economic activity. That means you should expect a crypto world where different chains specialize, much like Visa, Mastercard, and domestic bank networks coexist in payments. For you, that suggests a portfolio approach rather than a one-size-fits-all bet on a single smart-contract chain.

Institutions are already positioned for this. Research shared by Block Zero Real Estate says professional investors plan to allocate around 5–8% of their portfolios to tokenized assets by 2026. Major players, including Nasdaq and the DTCC, explore tokenized securities platforms, while DeFi protocols such as Ondo Finance bring tokenized treasuries on-chain. All of that liquidity needs blockchains that feel safe, fast, and cheap enough to use.

Today, Ethereum offers a deeper track record, higher asset value, and a more conservative approach for institutions that prioritize security and regulation. Solana offers speed and low fees that appeal to trading-heavy apps and consumer products. For a beginner, that boils down to this: Ethereum often behaves like the slower, older bank network, and Solana behaves like the flashy payment app that moves money instantly.

If you want to follow Solana’s growth story, you can watch how Solana DEXes already rival centralized exchanges in volume. Ethereum’s side of the story shows up every time big names like BlackRock or JPMorgan run pilots on smart-contract platforms and tokenized funds. Both trends matter because more real-world assets on-chain typically result in higher fees and increased activity for the underlying tokens over time.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What Are the Risks and How Should Beginners Position Around ETH and SOL?

First, this entire tokenization theme still sits in its early days. Regulation, technology bugs, or a shift in institutional preference can slow it down. Tokenized assets utilize blockchains under the hood, but your investment risk resides in the crypto tokens themselves (ETH, SOL), which remain volatile and can decline significantly in a risk-off market.

Second, “multi-chain” does not guarantee that every chain you hear about today will thrive. New competitors can appear, and older networks can lose developer interest or liquidity. Even Dragonfly’s Hadick says new blockchains may emerge and take market share, so treating any single chain as “guaranteed blue-chip forever” sets you up for disappointment.

If you want exposure, treat ETH and SOL as long-term, high-risk tech bets, not as savings accounts. Only invest money you can leave untouched for years, and that you can afford to see swing 50% or more. You can also stay chain-agnostic by focusing on education first: learn how tokenization works, how smart contracts function on tokenization on Solana, and how Ethereum’s role in stablecoins and RWAs continues to evolve.

As more treasuries, funds, and even real estate move on-chain, you will not need to guess a single winner—it will matter more that you understand why assets are migrating to blockchains in the first place.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post Solana vs Ethereum in Tokenization: Why It’s Not Winner-Takes-All appeared first on 99Bitcoins.