The obsession with gold continues: Tether, the stablecoin giant, is once again expanding its gold exposure. In a move that signals a major pivot toward hard assets, Tether has struck a definitive deal to invest $150 million into Gold.com. The agreement buys Tether approximately 12% of the precious metals giant and a seat on its board.

But this isn’t just an isolated bet; it’s a strategic deployment of capital fueled by a fortress balance sheet that just reported over $10 billion in annual profits. For Tether, this is a significant achievement compared to the rest of the market.

With gold prices surging and inflation narratives sticking, Tether is effectively building a bridge between its massive digital liquidity and the physical logistics of the bullion market.

Tether backs https://t.co/YdevlebMZU with $150M deal@Tether is investing $150 million to acquire a 12% stake in https://t.co/YdevlebMZU, partnering to integrate its XAU₮ gold token and expand access to both digital and physical gold.

The collaboration will allow users to… pic.twitter.com/pNlVPh3Jfd

— Crypto Miners (@CryptoMiners_Co) February 6, 2026

EXPLORE: Best New Cryptocurrencies to Invest in 2026

Vertical Integration: Tether Deal With Gold.com to Control the ‘Phygital’ Stack

Tether dominates the crypto market with USDT, but it wants to secure the physical backing for its other major play: Tether Gold (XAUT). Gold.com is an online marketplace where people buy real gold, silver, and platinum. By acquiring over 3.3 million shares of Gold.com, Tether isn’t just a passive investor; the companies are building a “vertically integrated” ecosystem.

Tether wants to control the stack: from the digital token in your wallet to the physical bar sitting in a vault. Juan Sartori, Tether’s Head of Special Projects, framed the move as merging “physical gold sourcing” with “digital asset infrastructure.”

This ensures their tokenized products have a rock-solid physical foundation, crucial for trusting RWA (Real World Asset) products.

Tether, the company that created USDT, has 140 tons of gold in a Swiss bunker.

$23 billion

They are adding 1 ton per week.

The company that invented "the digital dollar" is accumulating the most booming asset on the planet. pic.twitter.com/vyZJA4Wwd8

— Blade𝕏 _Freda_

(@Blade_Freda) January 31, 2026

EXPLORE: 9+ Best Memecoin to Buy in 2026

Boosting XAUT with a $20M Buyback and $100M Credit Line

A key component of this deal is a reciprocal arrangement designed to deepen market depth. As part of the agreement, Gold.com will pour $20 million of the investment proceeds directly back into XAUT. This gives the token a massive on-ramp via Gold.com’s retail platform, which includes giants like JMBullion.

The partnership goes deeper than equity. Tether has agreed to provide a gold leasing facility of at least $100 million to Gold.com. In the precious metals world, leasing is vital for operations, allowing dealers to hedge inventory without tying up cash.

For Tether, this creates a yield-bearing instrument backed by hard metal, creating a closed loop where users can seamlessly swap between stablecoins and physical bars.

DISCOVER: Best Meme Coin ICOs to Invest in 2026

The War Chest: Record $10B Profits and 534M Users Power the Expansion

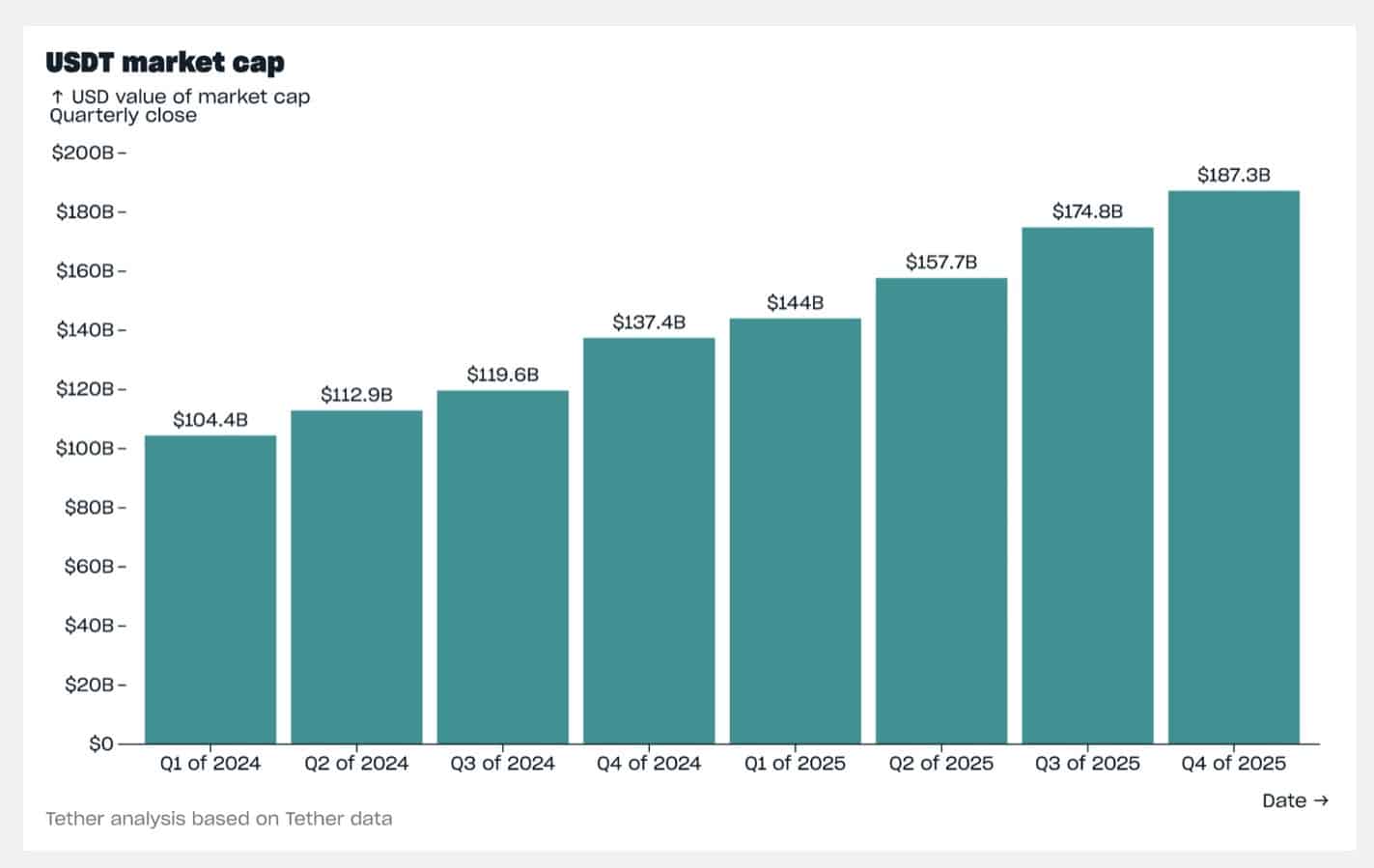

Tether’s ability to pivot into gold is underwritten by sheer financial dominance. The latest BDO-verified attestation reveals a company firing on all cylinders. USDT market cap climbed to $187.3 billion in Q4, adding $12.4 billion in just three months.

Reserves have pumped to $192.9 billion, creating a $6.3 billion excess equity buffer. Essentially a massive safety net against redemptions.

In the past months, user adoption has gone parabolic: Tether added 35.2 million new users in Q4 alone, pushing its global total to an estimated 534.5 million.

Even during the October market crash, USDT grew 3.5% while competitors shrank, cementing its status as the market’s primary flight to safety. With 70% of all on-chain stablecoin wallets holding USDT, Tether has the liquidity and the profits to reshape the gold market in its own image.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Tether $150M Deal With Gold.com: Stablecoin Giant Wants to Own the Supply Chain appeared first on 99Bitcoins.