Bitcoin’s famous “Uptober” rally may be late to the party this cycle. Data tracked by market analysts shows that February has quietly delivered stronger and more reliable gains than October over the past decade for Bitcoin.

Bitcoin’s average monthly gain sits near 2%, far below what many expected after the 2024 halving. Zooming out helps explain why patience, not panic, often pays during this part of the cycle.

EXPLORE: Top Solana Meme Coins to Buy in 2026

Why February Has Beaten “Uptober” More Often Than You Think

Seasonality sounds sketchy, but the idea is simple. Markets repeat patterns because humans repeat behavior.

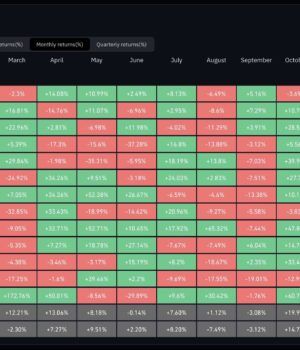

Since 2016, the week ending around February 21 has delivered Bitcoin’s highest median return, averaging about 8%. Bitcoin also closed higher roughly 60% of the time during that window, beating October’s reputation for steady gains.

February lines up with full-year corporate earnings and fresh guidance. That timing often pushes investors back into “risk-on” mode, which means buying assets that can move fast, like Bitcoin.

(Source: Coinglass)

This rotation helps explain why Bitcoin often rises even without crypto-specific news. Capital looks for growth when economic fear eases.

We saw similar behavior during past cycles and after the recent comparison between gold and Bitcoin performance, where liquidity drifted back toward digital assets.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Early February Also Acts as a Warning Signal: Bitcoin Should Start the Month Strong

History cuts both ways. In years where Bitcoin later struggled, the first three weeks of February showed weakness early.

In 2018, Bitcoin barely rose. In 2022 and 2025, it slid. Those years finished lower, which makes early-February price action a possible gut check.

Despite short-term swings, long-cycle models still point higher. Bitcoin’s recent pullback tracked stock market stress tied to tariff headlines, not a breakdown inside crypto itself.

That matches what we’ve seen during recent Bitcoin market struggles driven by macro fear, not network weakness.

Spot Bitcoin ETFs continue pulling in capital, reinforcing demand, while broader crypto confidence grew after changes like Ethereum’s 2023 upgrade and expanding institutional access.

February may not ring a bell at the bottom. But history shows it often starts the move that people only recognise later.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post The Real ‘Uptober’ for Bitcoin May Start in February appeared first on 99Bitcoins.