Solana price held steady this week as sentiment in the crypto industry improved and as investors bought the dip.

Summary

- Solana price has formed a highly bullish falling wedge pattern.

- Spot Solana ETF inflows have jumped to $613 million.

- The number of transactions and active users has soared.

Solana (SOL) token rose to $145 today, Nov. 28, up by 18% from its lowest point this month. Here are some of the top reasons why SOL token may be on the cusp of a roughly 80% surge.

Solana price falling wedge points to a rebound

The daily timeframe chart shows that SOL price has formed a combination of a falling wedge and a bullish divergence pattern.

It has been forming a falling wedge since September 25 this year. This pattern is characterized by two descending and converging trendlines.

A closer look at this chart shows that the token has already moved above the upper side of this wedge pattern. Also, top oscillators such as the Relative Strength Index and the Percentage Price Oscillator have begun to form a bullish divergence pattern.

The RSI has moved from the oversold level of 28 to 44. It has also moved above the descending trendline that links the highest swings since Sep. 18.

The two lines of the PPO indicator have made a bullish crossover. Therefore, a combination of these technicals point to an eventual rebound, potentially to the September high of $253, up by 80% from its lowest point this year.

Solana’s fundamentals are improving

SOL price rally is also driven by its strong fundamentals. First, data compiled by Nansen shows that Solana is the most active network in the crypto industry. Its transactions soared by 16% in the last 30 day to 1.84 billion, which are higher than other top chains like Ethereum, BSC, Base, and Arbitrum, combined. Its active addresses jumped by 13% in the same period to over 63.1 million.

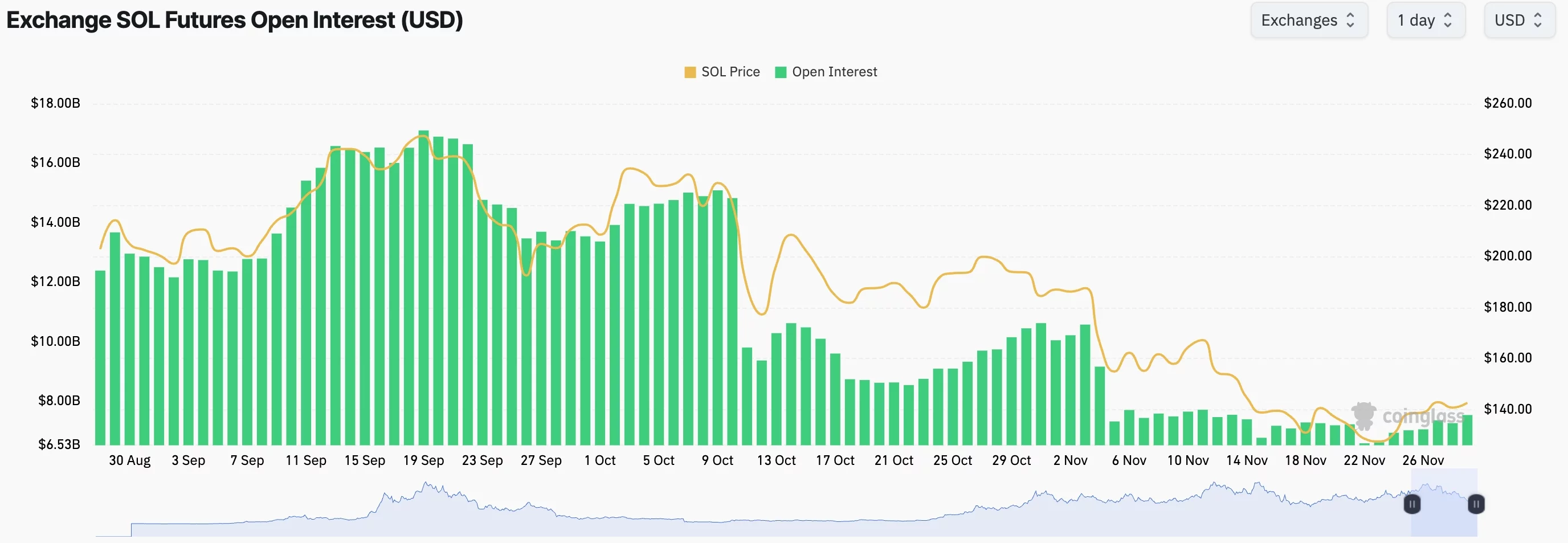

More data by CoinGlass shows that Solana’s futures open interest has started going up. It rose to $7.5 billion on Friday, up sharply from this month’s low of $6.6 billion. A rising open interest is a sign that investors are deploying leverage, which often boosts a coin’s price.

Finally, American investors are still accumulating their exchange-traded funds. Data shows that spot SOL ETFs have collected over $613 million in inflows, bringing the cumulative total to $917 million.

Solana ETFs hold about 1.15% of their market cap. A jump to Ethereum’s 5% would bring their total holdings to over $4 billion.