Donald Trump reportedly signaled he may not pick a rate-friendly Federal Reserve chair, and Bitcoin has seemingly reacted, dropping nearly -3% over the weekend following the President’s press conference on Friday (January 16).

BTC hovered just under $97,000 prior to the press conference, but Trump’s remarks on the Fed chair, coupled with the President imposing tariffs on a number of European countries, sparked a sizeable pullback across crypto, resulting in nearly $900M in liquidations.

This matters because in 2026, Bitcoin trades less like a rebel asset and more like a high-growth stock that reacts to interest rates and global macroeconomic issues. Lower rates usually push investors toward riskier assets, such as crypto. Higher-for-longer rates do the opposite. That’s the macro tug-of-war behind today’s price moves.

With the President hinting at a candidate who favours tighter policy, the markets’ early 2026 bullish price action could be put on hold until Trump and the Fed’s plans for 2026 are clearly laid out.

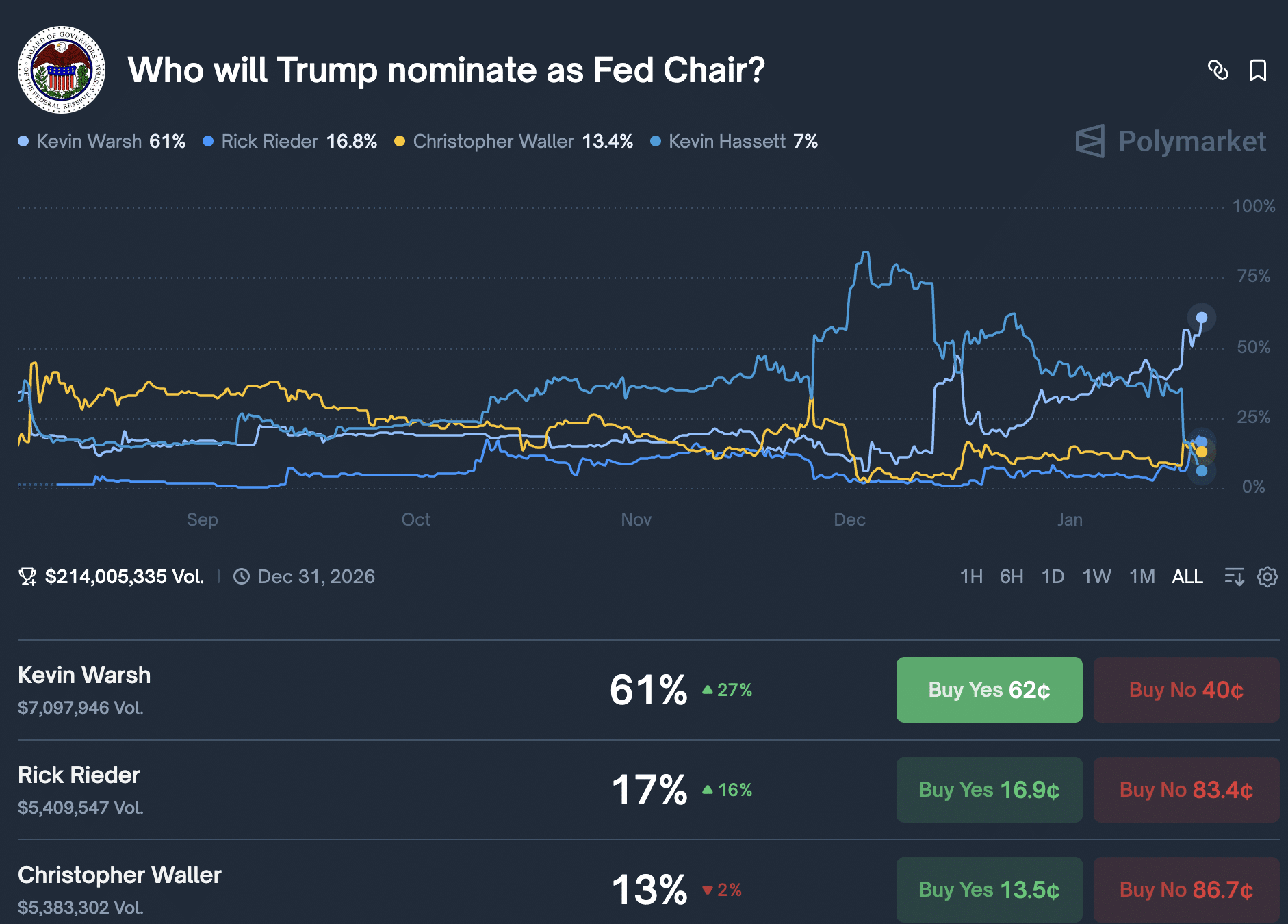

(SOURCE: Polymarket)

Why Does a Fed Chair Pick Matter for Bitcoin?

The Federal Reserve controls interest rates, which act like gravity for markets. When rates fall, borrowing gets cheaper, and money flows into assets like stocks and Bitcoin. When rates stay high, cash pays better, while risk assets lose some of their shine.

Trump hinted he may skip Kevin Hassett, a rate-cutter, in favor of Kevin Warsh, who favors tighter policy. According to Reuters, prediction markets flipped fast, and crypto traders followed.

On a January 16 press conference, the President stated that “I want to keep you where you are”, alluding to Hassett and Trump’s wish to keep him as the Chief Economic Advisor for his administration.

Crypto traders were hopeful that a rate-cutter such as Kevin Hassett would be the next Fed chair, which could help boost the market’s fortunes in 2026. A candidate like Warsh could put a stop to any further rate cuts, or even a hike, which would likely spell disaster for Bitcoin and the broader crypto market.

FED CHAIR RACE SHIFTS: WARSH EMERGES AS FRONTRUNNER Market expectations are shifting as #Hassett is increasingly seen as stepping aside in the race for the next Fed chair. #Prediction data now puts Kevin Warsh’s odds at around 60%, while Hassett has dropped to roughly 15%.… pic.twitter.com/q9Lkd5wMOL

— CoinRank (@CoinRank_io) January 19, 2026

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Trump’s Crypto Record Sets the Backdrop

This reaction makes sense because Trump already reshaped U.S. crypto policy. In 2025, he created a Strategic Bitcoin Reserve using about 200,000 seized BTC, according to AP News. That move told markets the US now treats Bitcoin like a national asset, putting its full weight

He also ordered the DOJ to stop most crypto prosecutions, ending what many called regulation-by-lawsuit. Add the GENIUS Act, which sets clear stablecoin rules, and you get a clearer, safer rulebook for investors.

The GENIUS Act is currently in the headlines after Coinbase pulled its support and fresh scepticism over the bill’s true intentions. If you want the bigger picture, this fits into the new US crypto regulation framework that traders now track as closely as price charts.

1/4 A quiet stablecoin detail just exploded into a full-blown BANK vs CRYPTO war

GENIUS Act bans issuers from paying interest on stablecoins.

They’re supposed to be digital cash, not savings accounts.

But the yield? It never died.

Exchanges like Coinbase still dish out… pic.twitter.com/CdXZRIz5k3

— Shivam Tandon (@shivamtas) January 10, 2026

What Does This Mean for Bitcoin Investors Right Now: Volatility Ahead?

In the short term, fewer rate cuts mean less fuel for fast rallies. That explains why Bitcoin still sits well below its $126,000 peak from October, even after a strong rebound from December lows.

Long term, policy clarity still helps. Pension funds and institutions care more about legal certainty than week-to-week price swings. Trump’s broader stance, covered in Trump’s crypto retirement plans, keeps that door open.

The takeaway for beginners? Bitcoin now moves on politics and macro news, not just hype cycles.

Fed chair hints are not final decisions. Trump can still surprise markets. Rates can still fall if inflation cools faster than expected.

Bitcoin also remains volatile. A 5–10% swing on headlines is normal. That’s why this is not rent-money territory. Size positions small. Think in years, not weeks.

Watch the Fed pick closely. In 2026, that choice may matter as much as the next ETF approval.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Trump’s Fed Chair Hint Jolts Bitcoin as Rate Cut Hopes Fade appeared first on 99Bitcoins.