Macro uncertainty is resurfacing, and it arrives at a challenging time for the crypto sector.

Digital assets are still under pressure, so traders head into Tuesday with one question on their minds: what will this week’s US data and regulatory signals mean for the market?

The next 48 hours carry key releases and fresh comments from the SEC, and both could shape rate expectations as the calendar moves into early December.

Any shift in the outlook tends to spill across global markets, tightening or loosening the liquidity that often drives Bitcoin and major altcoins.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

What Does the BEA’s Calendar Change Mean for Crypto Traders?

Bitcoin is holding near the high $80,000s after last week’s sharp decline. The pullback wiped more than $1 trillion from total crypto value over six weeks, based on several market estimates.

Today’s small bounce doesn’t change the broader picture. Prices remain well below October highs, and sentiment still feels strained.

The Bureau of Economic Analysis has changed its release calendar after the federal shutdown. It cancelled the usual advance estimate and shifted what would have been Wednesday’s second Q3 update to a new initial Q3 report on Dec. 23 at 8:30 a.m. ET.

The move pushes a key growth reading past month-end and removes one of the near-term macro events crypto traders were watching.

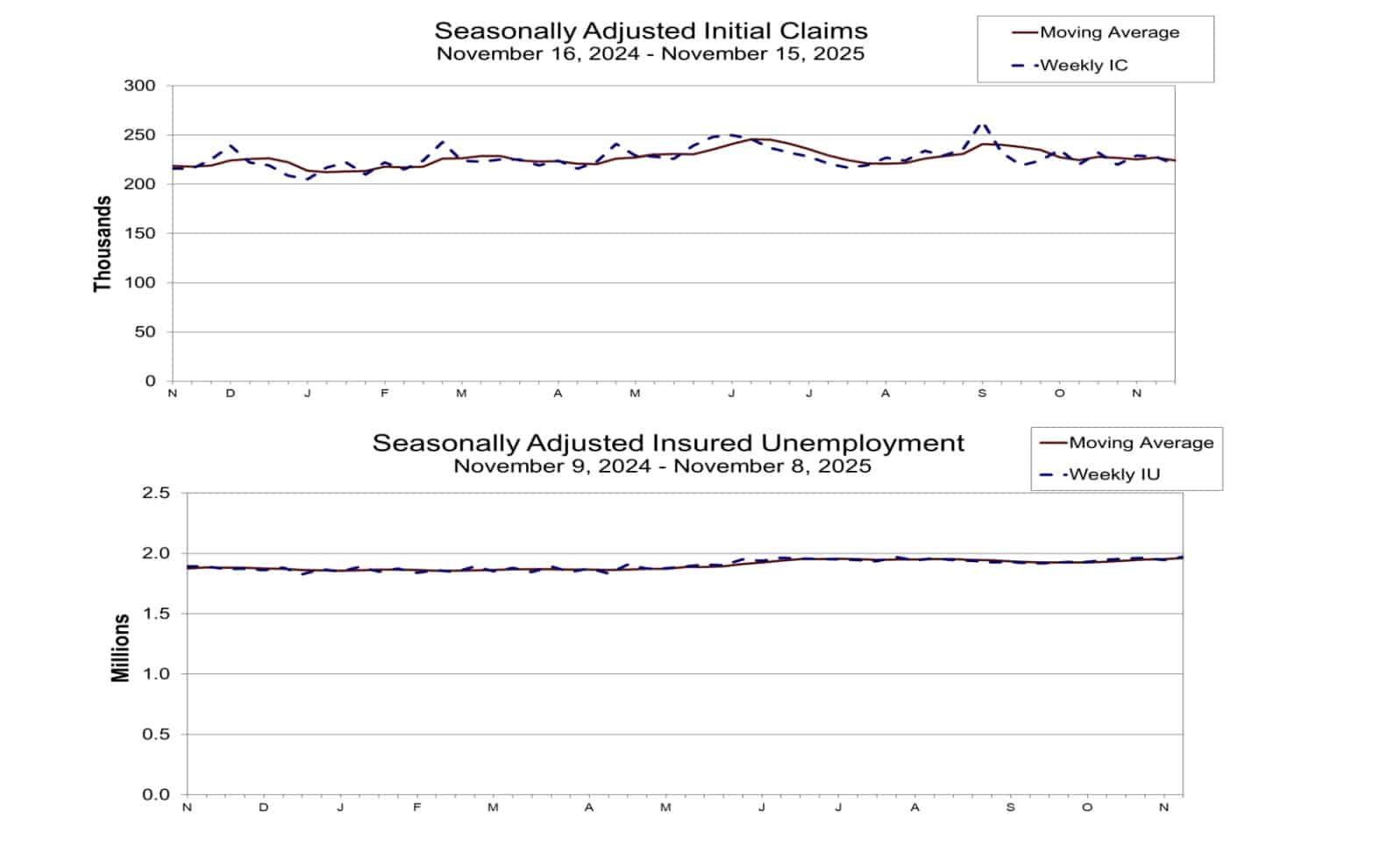

The Labor Department will publish the next weekly jobless claims report on Wednesday, Nov. 26, under the holiday schedule.

The most recent data showed 220,000 initial claims for the week ending November 15, while continuing claims reached 1.974 million.

That’s the highest level since 2021, and a sign traders use to judge whether the labor market is cooling and how that may shape rate-cut expectations.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What Could the SEC’s Tokenization Panel Mean for Digital Assets?

The Fed’s preferred inflation measure is due on Dec. 5 at 10 a.m. ET. It will be included in the delayed Personal Income and Outlays report for September. This data is another key signal for risk sentiment, but it will also come after the month closes.

The SEC’s Investor Advisory Committee has scheduled a public meeting for Dec. 4 with a panel on equity tokenization.

That keeps market-structure reform and the nuts and bolts of digital assets in focus at a time when the industry is still looking for direction after this month’s swings.

At the same time, new SEC rules and recent exchange filings have opened the door to a wider range of crypto-linked exchange-traded products, a shift issuers say could change how money flows into altcoins.

With fewer major US data releases ahead, Wednesday’s jobless claims now carry extra weight for crypto traders.

A weaker labor market reading could revive bets on earlier or deeper rate cuts in 2026, which often benefits risk assets like bitcoin and altcoins.

A stronger number would support the “higher-for-longer” rate view instead. The next key check on inflation is the Core PCE reading on Dec. 5, which will show how much disinflation is still in play.

Signals from the SEC on tokenization and ETP market plumbing may offer a slight boost to sentiment, but regulatory timelines are still slow compared to the rapid pace of price movements.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

The post What Will US Economic Data Mean For Crypto Crash? Latest SEC News, Prelim GDP, Jobless Claims and Core PC appeared first on 99Bitcoins.