Zcash price appears to be weakening despite the recent Grayscale ZEC ETF filing and rising corporate treasury interest on the privacy coin.

Summary

- Zcash had dropped to $470 despite a new spot ETF filing and corporate interest.

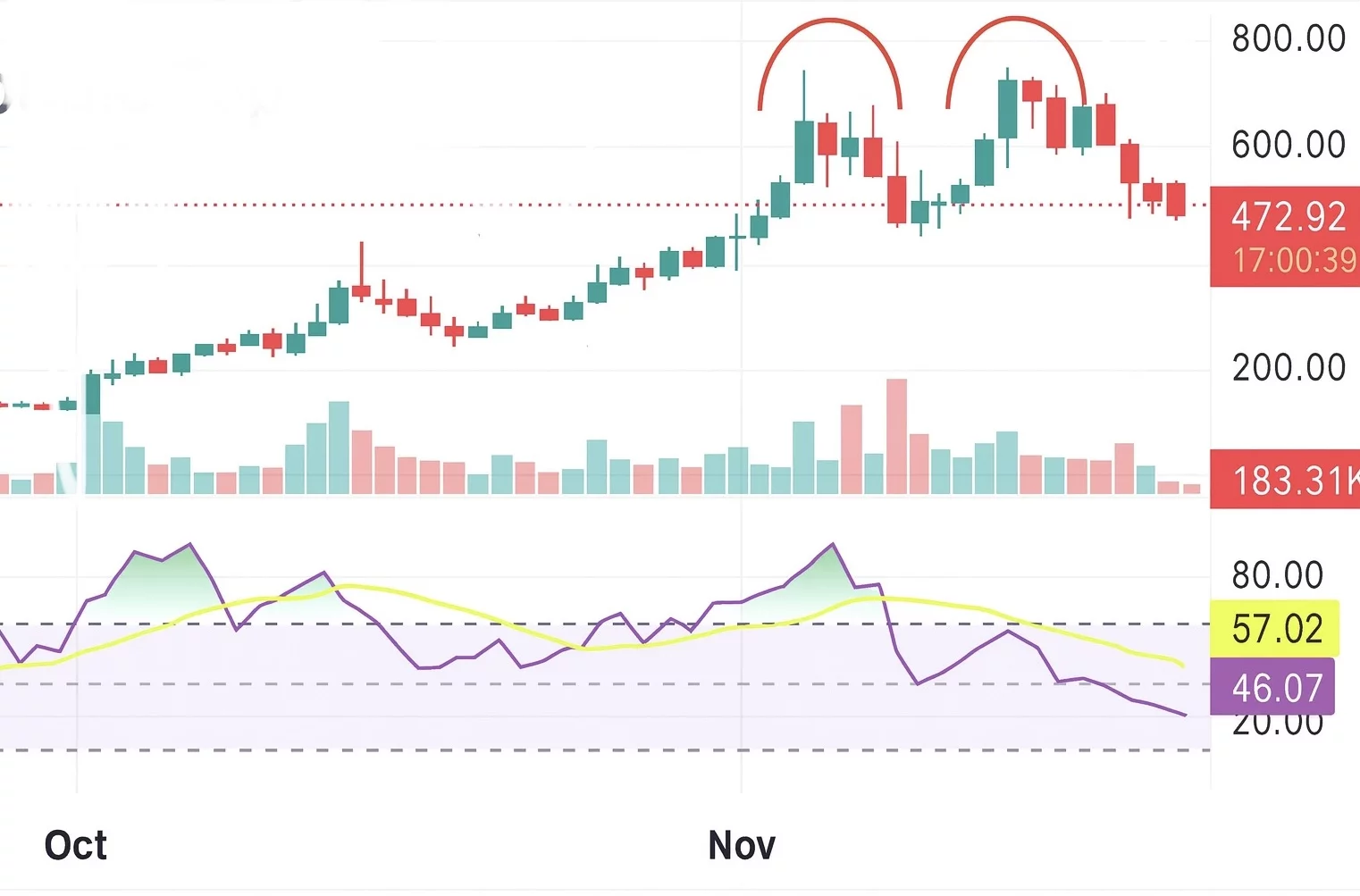

- Technical charts show a double top and weakening momentum.

- Trading volume and futures activity continue to fall after the rally.

Zcash was trading around $470 at press time, down 7.8% in the last 24 hours. The drop adds to a rough week for the coin, which is now 28% down in the past 7 days. Even so, ZEC is still up 37% over the past month after a strong November rally.

The slowdown comes at a time when trading activity appears to be cooling. Zcash (ZEC) saw $740 million in 24-hour spot volume , a 25.5% decline. In addition, data from CoinGlass shows derivatives volume down 16.36% to $3.15 billion, and open interest down 4.52%.

This mix likely suggests that traders are closing contracts as the market loses steam.

Grayscale ZEC ETF filing fails to lift sentiment

Zcash is losing momentum despite rising institutional interest. On Nov. 26, Grayscale filed an S-3 registration with the U.S. Securities and Exchange Commission to convert its Zcash Trust (ZCSH) into the first U.S. spot Zcash ETF. The fund would trade on NYSE Arca and offer regulated exposure to ZEC.

Grayscale described ZEC as a natural component of a “balanced digital asset portfolio,” noting the resurgence in global demand for privacy-focused blockchains. The filing also acknowledged previous regulatory pressure that resulted in multiple ZEC delistings in 2023–2024, though the project’s market cap has since recovered to above $8 billion.

Corporate interest is also rising. Reliance Global Group, a Nasdaq-listed insurance technology firm, converted its entire digital treasury into Zcash, liquidating Bitcoin, Ethereum, Cardano, and XRP. The company called ZEC the “most compelling” long-term digital asset for privacy-enabled transactions.

That puts Reliance in the same camp as other privacy-forward investors, including Cypherpunk Technologies, which accumulated over 200,000 ZEC this month.

Here’s why Zcash price is falling

Despite the positive institutional backdrop, the recent sell-off is largely tied to technical exhaustion. ZEC’s rally in November sent the relative strength index soaring past 80, a clear sign the market was getting overheated.

Not long after, the price fell out of its rising channel and then dropped below a symmetrical triangle. Both patterns often show that a strong trend is running out of steam. At the same time, retail traders piled into futures right near the peak, essentially giving bigger players the liquidity they needed to exit their positions.

Today’s chart paints a cautious picture. ZEC printed a clear double top near the $780–$800 range, a classic reversal formation. The neckline sits around $470, which ZEC is currently testing. A firm close below this level would confirm the bearish pattern.

Current indicators paint a mixed picture. The RSI is now at 46, which is neutral. Momentum and MACD show sell signals. Short-term moving averages (10 to 30-day) also point down. But the longer-term averages (50-day to 200-day) still point up, which means the bigger trend has not fully turned bearish.

If ZEC holds $470, it could bounce towards the $550–$600 region. A break above $600 would ease the pressure from the double top and give bulls a chance to push higher.

On the flip side, if ZEC falls below $470, the next support sits around $450, with a deeper move possibly reaching the $420 area. Short-term momentum still favors sellers.