UBS has taken a firm stance against digital assets, declaring that “crypto is not an asset” as Bitcoin whales and ETF investors begin pulling capital from the market.

Bitcoin managed a bump to $70K this morning, but don’t pop the champagne just yet; the original cryptocurrency is still down 50% from its October highs.

DISCOVER: Best New Cryptocurrencies to Invest in 2026

Why UBS’s Stance Matters for Bitcoin Investors

When a banking giant like UBS says crypto is held by a “tiny portion of society,” it stings, especially since they have previously moved to open crypto access for private clients.

This mixed messaging matters because institutional approval usually brings stability to the market. Instead, we are seeing the opposite.

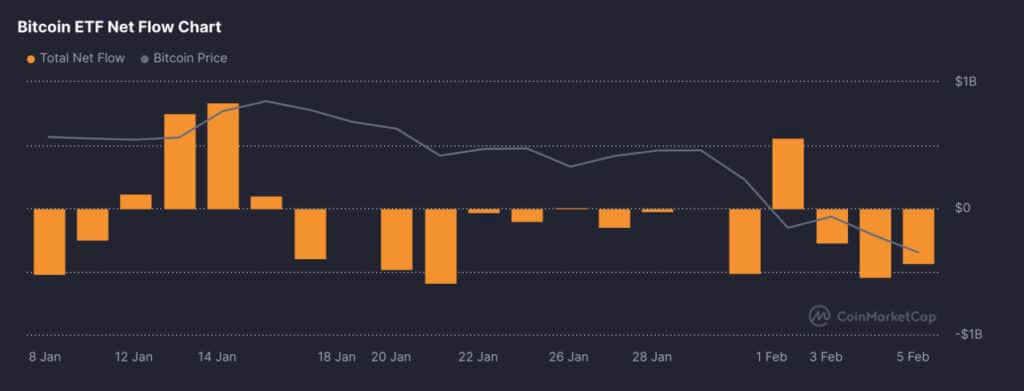

(Source: Bitcoin ETF Net Flow / CMC)

Jefferies analyst Andrew Moss warns that “crypto winter” chatter is back, and frankly, it feels like it. With Bitcoin crashing from its $125K peak to current levels, the big money isn’t buying the dip; they are selling into it.

When major institutions turn bearish, it often signals a tougher road ahead for retail investors like us.

DISCOVER: Top 20 Crypto to Buy in 2026

What Whale and ETF Activity Reveals About Market Sentiment

The numbers look pretty ugly right now. According to Jefferies, “whales”, those massive wallets holding huge amounts of BTC, have transitioned to being net sellers as of last weekend. They aren’t just holding through the storm; they are actively selling while prices are weak, claiming few bullish indicators suggest we are near a bottom.

It’s not just the anonymous whales, either. Every day, investors using traditional finance platforms are bailing out, too. We saw spot Bitcoin ETF outflows hit their second- and third-largest volumes ever in late January, followed by another massive exit on February 4. This suggests that the “tourism” money that flooded in via wealth management channels is drying up fast.

(Source: TradingView)

Even Michael Saylor’s “Bitcoin treasury company” (Strategy) is feeling the heat. Their stock has plummeted 75% from its peak, and their market cap is now billions less than the Bitcoin they actually own.

While they claim they can survive a 90% drop, the market is clearly in “peak fear” territory right now.

DISCOVER: Top Solana Meme Coins to Buy in 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis

The post UBS Says ‘Crypto Is Not an Asset’ as Bitcoin Whales and ETFs Pull Back appeared first on 99Bitcoins.